Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Nonconsolidated Statements of Financial Position. December 31, 2020 and 2019. The accompanying notes form an integral part of these financial statements.

Typology: Study Guides, Projects, Research

1 / 35

This page cannot be seen from the preview

Don't miss anything!

Nonconsolidated Financial Statements December 31, 2020 and 2019

Table of Contents December 31, 2020 and 2019

Nonconsolidated Statements of Financial Position December 31, 2020 and 2019 The accompanying notes form an integral part of these financial statements. $ thousands 2020 2019 Assets Non-current assets: Investments in subsidiaries (note 3) 28,564,877 28,394, Funds in escrow (note 10,16) 979 1, Deferred taxes (note 8) 5,300 7, Total non-current assets 28,571,156 28,403, Current assets: Cash and cash equivalents (note 10) - - Investment in equity shares of Ultimate Parent (note 10,11) 78,761 2, Prepaid expenses (note 13) 4,298 7, Net amounts due from Unilever Group affiliates (note 9) 1,701 6, Total current assets 84,760 16, Total assets 28,655,916 28,419, Liabilities and Equity Equity: (note 14) Called up share capital 1 1 Share premium 1,350,172 1,350, Retained earnings 17,671,700 16,023, Total equity 19,021,873 17,374, Non-current liabilities: Liabilities to employee benefit plans (note 5) 15,375 20, Liabilities for share-based compensation (note 6) - 3, Other - 1 Total non-current liabilities 15,375 23, Current liabilities: Trade and other payables (note 15) 20,063 19, Provisions (note 16) 8,441 6, Liabilities to employee benefit plans (note 5) 3,453 2, Liabilities for share-based compensation (note 6) 6,641 5, Net amounts due to Unilever Group affiliates (note 9) 1 40 Net amounts due to UNUS Group affiliates (note 9) 9,580,069 10,987, Total current liabilities 9,618,668 11,021, Total liabilities and equity 28,655,916 28,419,

Nonconsolidated Statements of Comprehensive Income Years Ended December 31, 2020 and 2019 The accompanying notes form an integral part of these financial statements. $ thousands 2020 2019 Net income 3,836,182 175, Items that will not be reclassified to income: Actuarial gains (losses) on benefit programs, net of tax (expense) benefit of $994 in 2020 and ($117) thousand in 2019 (3,134) 123 Comprehensive income 3,833,048 175,

Nonconsolidated Statements of Changes In Equity Years Ended December 31, 2020 and 2019 The accompanying notes form an integral part of these financial statements. $ thousands Share Share Retained Total Capital Premium Earnings Equity, December 31, 2018 17,789,660 1 1,341,561 16,448, Net income 175,681 - - 175, Comprehensive income 123 - - 123 Capital contribution 8,611 - 8,611 - Dividends declared (600,024) - - (600,024) Equity, December 31, 2019 17,374,051 1 1,350,172 16,023, Net income 3,836,182 - - 3,836, Comprehensive loss (3,134) - - (3,134) Dividends declared (2,185,226) - - (2,185,226) Equity, December 31, 2020 19,021,873 1 1,350,172 17,671,

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019 (d) Financial Asset A financial asset is recorded at fair value through profit or loss if it is classified as held for trading or designated as such upon initial recognition. Financial assets are designated at fair value through profit or loss if the Company manages such investment and makes purchase and sale decisions based on their fair value in accordance with the Company’s documented risk management or investment strategy. Financial assets at fair value through profit or loss are measured at fair value, and changes therein are recognized in profit or loss. The Company’s financial asset consists of an investment in shares of the Ultimate Parent. The Company acquires Unilever PLC American Depository Receipts (“ADRs”) to satisfy obligations under share-based compensation programs in the near term. These equity securities are recorded at fair value. Loans and receivables are financial assets with fixed and determinable payments that are not quoted in an active market. Such assets are recognized initially at fair value plus any directly attributable transaction costs. Subsequent to initial recognition, loans and receivables are measured at amortized cost using the effective interest method, less any impairment charges. (e) Cash and Cash Equivalents Cash and cash equivalents are financial assets and include deposits, investments in money market funds and highly liquid investments that have are the following characteristics: Are readily convertible into cash Have an insignificant risk of change in value and Have a maturity of three months or less at acquisition (f) Investment in Subsidiaries Investments in the Company’s subsidiaries are recorded at cost. (g) Financial Liabilities Financial liabilities are recognized initially on the trade date at which the Company becomes a party to the contractual provisions of the instrument. The Company derecognizes a financial liability when its contractual obligations are discharged or canceled or expire. Financial assets and liabilities are offset and the net amount presented in the statements of financial position when, and only when, the Company has a legal right to offset the amounts and intends either to settle on a net basis or to realize the asset and settle the liability simultaneously.

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019 The liabilities to employee benefit plans in the statements of financial position are comprised of the present value of the defined benefit plan obligation (determined using the projected unit credit method) allocable to UNUS. That liability is discounted using rates based on high quality corporate bonds less the fair value of plan assets allocable to UNUS. All of the Company’s defined benefit plans are subject to annual independent actuarial valuations prepared as of the reporting date. With respect to defined contribution plans, the Company records an expense in the statements of operations equal to its contribution payable to each plan. The Company’s obligation under defined contribution plans is limited to the amounts required to be contributed each year. The assets and liabilities of defined contribution plans are not reflected in these financial statements. (k) Income Taxes The Company files its tax returns on a consolidated basis with the UNUS Group for U. S. federal purposes and in many states in which it conducts business. Income taxes reflected in these financial statements are determined using the pro rata method whereby current and deferred income taxes are allocated to members of the UNUS Group based on each member’s relative contribution to the UNUS Group’s consolidated income tax expense or benefit. Income taxes are comprised of current and deferred tax. Current taxes are based on the enacted and substantively enacted tax rates and are recognized in the statements of operations except to the extent that they relate to items recognized directly in equity. Current tax benefit may also include adjustments to amounts recorded for tax assets and liabilities in prior years. The Company recognizes deferred taxes using the asset and liability method on its temporary differences and on any carryforwards except to the extent benefits are not expected to be utilized by the consolidated UNUS Group. Deferred taxes are based on the expected manner of realization or settlement using tax rates enacted or substantively enacted as of the fiscal year end. Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income tax is related to the same regulatory authority. Deferred taxes are not provided on temporary differences related to investments in subsidiaries to the extent that it is probable they will not reverse in the foreseeable future. (l) Provisions Provisions are recognized when the Company has a present obligation (legal or constructive) arising from a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate of the amount of the obligation is available. Provisions are discounted if the effect is material to the financial statements. No provisions were discounted in these financial statements.

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019 (m) Impairment of Assets A financial asset not carried at fair value through profit and loss is assessed at each reporting date to determine whether there is objective evidence that it is impaired. A financial asset is impaired if objective evidence indicates that a loss event has occurred after the initial recognition of the asset and that the loss event had a negative effect on the estimated future cash flows of that asset that can be estimated reliably. Objective evidence that financial assets are impaired can include default or delinquency to a debtor, restructuring of an amount due to the Company on terms that the Company would not consider otherwise, indications that a debtor or issuer will enter bankruptcy, or the disappearance of an active market for a security. In addition, for an investment in an equity security, a significant or prolonged decline in its fair value below cost is objective evidence of impairment. Annually, in accordance with IAS 36 – Impairment of Assets, the Company determines whether indicators of asset impairment exist, particularly with respect to its investments in subsidiaries and its receivables from entities within the Unilever Group. There were no indicators of impairment in 2020 or 2019, and therefore no impairment recorded in 2020 or 2019. (n) Leases – Significant Accounting Policy The right-of-use asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received. The right-of-use asset is subsequently depreciated using the straight-line method from the commencement date to the end of the lease term, unless the lease transfers ownership of the underlying asset to the Company by the end of the lease term or the cost of the right-of-use asset reflects that the Company will exercise a purchase option. In that case the right-of-use asset will be depreciated over the useful life of the underlying asset, which is determined on the same basis as those of property and equipment. In addition, the right-of-use asset is periodically reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability. The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing rate. Generally, the Company uses its incremental borrowing rate as the discount rate. Lease payments included in the measurement of the lease liability comprise the following:

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019 During the year ended December 31, 2020 and 2019, the Company received dividends totaling $4. billion and $600 million from Conopco, respectively.

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019

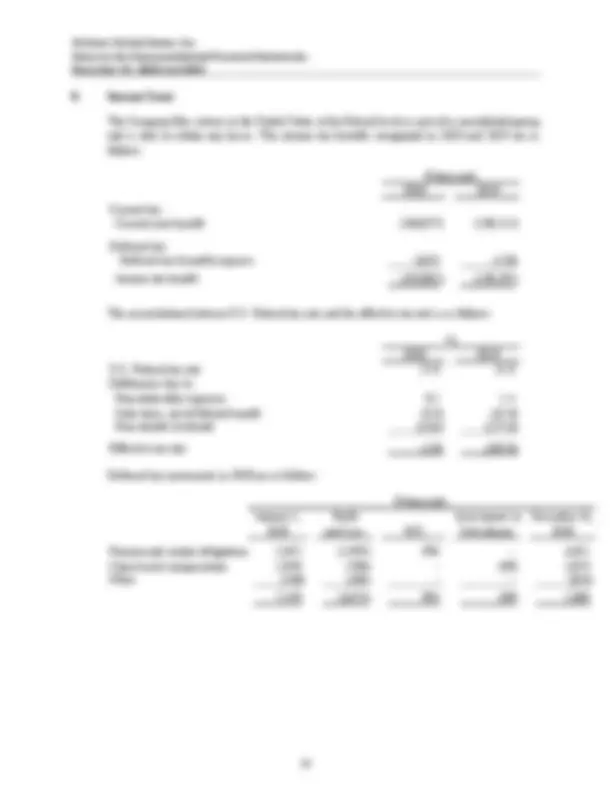

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019 Sensitivities The sensitivity of pension and post-retirement health benefit liabilities to changes in key assumptions are as follows: Change in Change in Change in Liabilities Liabilities Assumptions Pension Post-retirement Health Discount rate Increase by 0.1% -1.4% -0.7% Inflation Increase by 0.1% 0.0% -0.1% Long-term medical care rate Increase by 0.1% 0.0% 0.0% An equivalent decrease in the indicated rates would have a commensurate effect in the opposite direction. Sensitivity analyses have been determined based on reasonably possible changes in the respective assumptions occurring at the end of the reporting period and may not be representative of an actual change. The analysis is based on a change in the key assumption while holding all other assumptions constant. The methods and types of assumptions used in preparing the sensitivity analysis did not change when compared in the prior period. Valuations of other post-retirement benefit plans assume a higher initial level of medical cost inflation, which drops from 7% to the long-term rate of 5% within 5 years. Healthcare cost trend assumptions can have a significant impact on the amounts reported for healthcare plans. Statements of Operations Net defined benefit cost of the plans charged to the statement of operations for the Company and for the plans as a whole for the years ended December 31, 2020 and 2019 and 2019are as follows: $ thousands Company The Plans 2020 2019 2020 2019 Charged to operating profit: Current service cost 645 945 10,957 16, Special termination benefits - - - - Past service cost - - - (9,600) Settlements/curtailments - - 2,178 4, Total operating costs 645 945 13,135 11, Charged to finance costs: Interest on retirement benefits 2,268 2,787 48,542 62, Expected return on assets (1,647) (1,852) (32,473) (37,874) Finance costs 621 935 16,069 24,

Notes to the Nonconsolidated Financial Statements December 31, 2020 and 2019 Statements of Comprehensive Income Net defined benefit cost of the plans charged to comprehensive income for the Company and for the plans as a whole for the years ended December 31, 2020 and 2019 are as follows: $ thousands Company The Plans 2020 2019 2020 2019 Actual return less expected return on plan assets (^) 6,954 12,212 97,818 164, Experience gains (losses) (5,159) (4,166) (21,418) 5, Changes in assumptions (5,923) (7,807) (119,687) (134,609) Net pre-tax actuarial gain (loss) recognized in comprehensive income (4,128) 239 (43,287) 34, Statements of Financial Position The assets, liabilities and deficit position of pension and other post-retirement benefit plans at December 31, 2020 and 2019 related to the Company’s participation in such plans are as follows: $ thousands 2020 2019 Other Post- Other Post- employment employment Pension Benefit Pension Benefit Plans Plans Plans Plans Principal plan assets: Equities 20,058 - 17,495 - Bonds 37,330 - 31,557 - Other 82 - 1,211 - 57,470 - 50,263 - Present value of liabilities: Principal plans 61,555 6,880 57,468 7, Other plans 7,863 - 8,415 - 69,418 6,880 65,883 7, Pension liability net of assets (11,948) (6,880) (15,620) (7,176) Funded plans in deficit 4,085 - 7,205 - Unfunded Plans 7,863 6,880 8,415 7, 11,948 6,880 15,620 7,