Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An introduction to marginal functions and elasticities in economics. It covers the concepts of marginal demand, marginal sales, marginal revenue, and marginal cost, and explains how these elasticities measure the proportion of change in demand or cost. The document also includes examples of partial derivatives and their interpretation in economic decision-making.

What you will learn

Typology: Cheat Sheet

1 / 21

This page cannot be seen from the preview

Don't miss anything!

After studying this unit, you should be able to:

� (^) identify a wide range of techniques used in managerial economics;

� (^) apply the techniques to understand the meaning of the results;

� (^) identify the strengths and weaknesses of the different methods.

3.1 Introduction

3.2 Opportunity Set

3.3 Variables and Constants

3.4 Derivatives

3.5 Partial Derivatives

3.6 Optimisation Concept

3.7 Regression Analysis

3.8 Specifying the Regression Equation

3.9 Estimating the Regression Equation

3.10 Decision Under Risk

3.11 Uncertainty Analysis and Decision Making

3.12 Role of Managerial Economist

3.13 Summary

3.14 Self-Assessment Questions

3.15 Further Readings

The manager needs various techniques to assist and help him in making decisions that will ultimately maximise the value of the firm. These techniques and tools are quantitative in nature. The introduction of some commonly used tools used in managerial decision making becomes imperative.

In this unit we are going to discuss some basic techniques which would be helpful in understanding the concept of managerial economics, in turn helping us to apply these techniques as and when required.

A set is a collection of distinct or well defined objects like (5, 6, 7) or (a, b, c). For example listing of all residents of Delhi or all animals in a zoo is difficult. Thus a set is also formed by developing a criterion for membership. For example the set of all positive numbers between 1 and 10 or set of all points lying on the line x + y = 4.

In managerial economics the need is to define an opportunity set of a decision maker, i.e., the set of alternative actions which are feasible. For example, the opportunity set of a consumer is the set of all combinations of goods which the consumer can buy with his given income. Given the consumer’s budget and prices of all goods, the opportunity set is well defined, and we can find out whether the

Introduction to Managerial Economics

Five key functions of economics are represented graphically:

1. Demand (Linear)

Figure 3.

2. Total Revenue (Quadratic)

Figure 3.

3. Production (Short run) (Cubic)

Figure 3.

LINEAR Q = a – bP P = a + bQ

TR = a + bQ – CQ 2 (a = 0)

TP = a + bL + CL 2 – dL 3 (a = 0)

Basic Techniques

Price

Quantity

Labour

Introduction to Managerial Economics = Q

Average revenue

Average costs

When marginal concept is divided by corresponding average concept, we get the measure of economic concept of elasticity.

Output elasticity of cost

Advertisement elasticity of sales revenue

Thus, such elasticities measure the proportion of change, e.g., if the percentage change in demand is greater than the percentage change in price, then

⎥

⎥ ⎦

⎤ ⎢

⎢ ⎣

⎡

1 is elastic demand.

⎥

⎥ ⎦

⎤ ⎢

⎢ ⎣

⎡

< 1 is inelastic demand.

⎥

⎥ ⎦

⎤ ⎢

⎢ ⎣

⎡

= 1 is unitary elastic demand and so on.

Elasticity is discussed in detail in Block 2.

The standard rules of differentiation in calculus are given in Appendix.

3.5 PARTIAL DERIVATIVES

In managerial economics, usually a function of several independent variables is encountered instead of a single variable case shown above. For example, a consumer’s demand for a product depends on the price of the product, price of other related goods, income, tastes, etc. When price changes, the effect on quantity demanded of the goods can be analysed only when all other variables are kept constant. The functional relationship that is obtained between the quantity demanded of a product and its own price is called a Partial Function (a function of one variable when all other variables are kept constant). The derivative of the partial functions are known as partial derivatives of the original function and is shown as df/dx 1 or f 1 ( x ) or f’(x). The conventional symbol used in maths for the partial derivative is delta, d. Partial derivatives are functions of all variables entering into the original function f (x).

Examples:

(i) (^) if Y=f(x 1 ;x 2 )x 12 x 22

Then

2 1 2 1

2xx

δ×

δ

Basic Techniques

And

2 2 2 1

2 1 2

x 2 x 2 x x x

y = = δ

δ

(ii) (^) If Y= x 1 x 2 =(x 1 x 2 )^1 /^2 =x 11 /^2 x 21 /^2

1 / 2 2

1 / 2 =x 1 x

Then 1

2 1/ 1

1/ 1/2 2 2

1/ 1 1 x

x 2

x

x 2

x x 2

δx

δ y = − = =

And 2

1 1/ 2

1/ 1 / (^21) 2

1 / 2 1 2 x

x 2

x

x 2

x x 2

x

y = = = δ

δ (^) −

(iii) If Z = (^4) x 2 +3xy+5y^2

Then (^) y 8x 3y

δ

δ

Then (^) y 3x 10y

δ

δ

Remember the derivative of a constant is 0, i.e., (^) δz/δx of 5y 2 is 0. Thus in the

above equation while calculating d z/ d y we hold x constant and hence (^) δz/δx of 4 x^2

is 0. This gives (^) δz/δx to be 8x + 3y ; and (^) δz/δx to be 3 + 10y.

x

y , y

f , x

f δ

δ δ

δ δ

δ , δx

δf 2

are called first order partial derivatives.

The second order partial derivatives indicate that the function has been differentiated partially twice with respect to a given variable, all other variables being held constant. These are shown (in case of function Z = f(x, y) by

x

f .Thus y

f orf and x

f 2

2 2

2 2 xx

2

δ

δ δ

δ δ

δ shows the rate of change of first order partial

derivatives fx with respect to x with y held constant.

Similarly (^2)

2

y

f δ

δ is the second order partial derivative of the function with respect to

y with x held constant.

3.6 OPTIMISATION CONCEPT

Optimisation is the act of choosing the best alternative out of the available ones. It describes how decisions or choices among alternatives are taken or should be made. All such optimisation problems have 3 elements:

a) Decision Variables: These are variables whose optimal values have to be determined. For example, a production manager wants to know at what level to set output in order to achieve maximum profit or maximum sales revenue. Here output is the decision or choice variable. Similarly labour, machine, time and raw materials are choice variables if a works manager wants to know what amount of these are to be used so as to produce a given output level at minimum cost. The quantity of any choice variable must be measurable (20kg, 5 labourers, 10 hours, etc.).

which is negative. Hence total revenue is maximised when output is 45 units.

b) From profit function

p =TR – TC TC = (AC) x Q = (Q 2 – 8Q + 57 + 2/Q) Q = Q 3 – 8Q 2 – 57Q + 2 TR = (45 – 0.5 Q)Q = 45 Q – 0.5 Q 2 After substituting TR and TC, we get p = 45Q – 0.5Q 2 – Q 3 + 8Q 2 – 57Q – 2 ² dp/dQ = 45 – Q – 3Q 2 + 16Q – 57 = –3Q 2 + 15 Q – 12

dividing by – Q^2 – 5Q + 4 = 0 or (Q – 4) (Q – 1) = 0

Þ Q = 4 or 1

There are many situations where the objective function has to be maximised or minimised subject to certain constraints present in the problem. Thus a consumer may be maximising utility subject to the income constraint.

The techniques used to analyse such problems are based on that used for unconstrained problems. The constrained problem is converted into unconstrained one with the help of Lagrange Multiplier Technique and then the latter is solved. In this technique, the objective function and constraint is combined in one expression (Lag range expression) such that the constrained maximisation or minimisation problems are reduced to unconstrained ones.

For example,

Maximise Y = –x 2 + 8x + 20 subject to x 7 2 (function of single independent variable)

The objective function (function to be optimised) is Y= –x^2 +8x+20, plotted on graph:

Figure 3.11: Objective Function

10

20

Introduction to Managerial Economics

The objective function y = –x 2 +8x+20 can be written as y = –(x–4)^2 +

Now –(x–4)^2 has an unconstrained maximum value of zero at x = 4. However, our objective functions is –(x–4)^2 +36, and hence will have an unconstrained maximum of 36 (at x=4). This is so for the first derivative test

The second derivative test gives–^2 dx

dy 2

2 since (^) dx–2x^8

dy

dy = + – 2 dx

dy 2

Thus both tests give x=4 as the value of the variable. This is the value at which the objective function attains unconstrained maximum. However, the problem has a constraint x=2. Thus we have to consider the function only up to value of x= (graph) starting from x= –2. The maximum value of the function is then 32 which occurs when x=2. Thus the constrained maximum of the function y = –(x–4) 2 + 36 with constraint x=2 would occur at x=2 and not x=4.

The Lagrange expression for constrained maximisation is formed as follows Y = – (x–4)^2 + 36 with constraint x=2 or x–2=0.

Combining, we get the Lagrange expression L = [–(x–4)^2 + 36] +l (x–2).

adding objective function and product of l (Lag range Multiplier) and the constraint function x–2=0. Now L is a function of x and.

We find

setthemto 0

and x

δλ

δ δ

δ

2 (x 4 ) 0

=− − +λ= δλ

δ

(x 2 ) 0 x

δ

δ

The last equation gives x=2. Hence the constrained maximum occurs at x=2.

In this problem l = 2(x–4) = 2(2–4) = –

When applying Lagrange technique to solve economic decision problem, l will have an economic significance. For example in consumer’s utility maximising problem (where quantities of commodities are choice problems), l will be the marginal utility of money income. In producer’s cost minimisation profit, l will be the marginal cost of production. In complex problems, as many l’s as many there are constraints have to be used.

The problem with two independent variables can also be solved with Lagrangian technique. To find out whether the optimised value is maximum or minimum however, requires second derivative test as well as use of some more determinants not to be discussed here.

Activity 1

a) Draw graph of the following functions: i) Q = 10 – 0.4 P ii) Q = 15 – 2P + 4P^2 iii) C = 100 + 0.8 Y

Basic Techniques

Introduction to Managerial Economics

This is the equation for a straight line, with X plotted along the horizontal axis and Y along the vertical axis. The parameter a is called the intercept parameter because it gives the value of Y at the point where the regression line crosses the Y-axis. (X is equal to zero at this point). The parameter b is called the slope parameter because it gives the slope of the regression line. The slope of a line measures the rate of change in Y as X changes (DY/DX); it is therefore the change in Y per unit change in X.

Intercept parameter: The parameter that gives the value of Y at the point where the regression line crosses the Y-axis.

Slope parameter: The slope of the regression line, b = ¦Y/¦X, or the change in Y associated with a one-unit change in X.

Y and X are linearly related in a regression model. The effect of change in X on the value of Y is constant. A one-unit change in X causes Y to change by a constant b units.

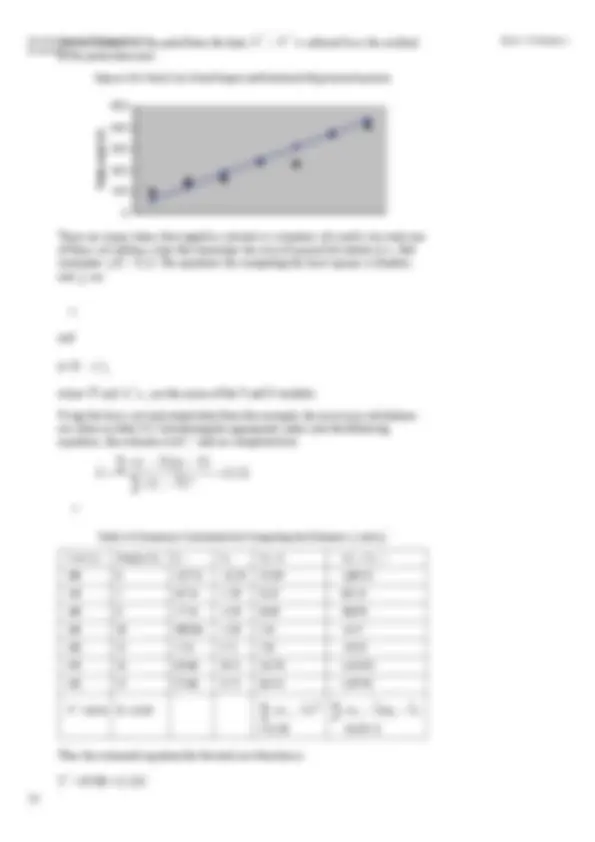

The figure shows the true relation between sales and advertising expenditures. If a firm chooses to spend nothing on A, its sales are expected to be 100 crores per month. If the firm spends 30 crores on A then it can expect sales of 250 crores (=100 + 5 × 30). ¦S/¦A = 5, i.e., for every 1 unit increase on advertising, the firm can expect a 5 unit increase in sales. Regression involves identifying and calculating specific relationships between the independent variables and the dependent variable. It involves a number of stages which are described in another section.

Activity 2

a) The slope parameter is .............................. and the intercept parameter is .............................. in the equation R = a + bW. b) In Figure 3.12, what will be the monthly sales of the firm, if the advertising expenditure is increased from 30 crores to 40 crores per month? ...................................................................................................................... ...................................................................................................................... ...................................................................................................................... ......................................................................................................................

Figure 3.12: Relation between sales and advertising expenditure^ Basic Techniques

250

300

550

30 40 90

100

Sales per month (crores)

Expenses on advertising per month (crores)

A

Regression Line S = 100 + 5A

S

3.8 SPECIFYING THE REGRESSION EQUATION

The first thing that the organisation carrying out the regression analysis needs to do is to determine the range of variables which may affect demand for the product concerned. For example, the own price of a good might reasonably be expected to be a determinant of demand for most products, as would any advertising being done by the firm. The question of whether there are any substitute or complementary goods which need to be taken into account could then be raised. In the case of, an expensive consumer durable good, the cost and availability of credit might be a consideration. Any special ‘other’ factors affecting demand could then be identified and so on. This choice of variables has to be made before it is possible to progress to the next stage.

Once the relevant variables have been identified, quantitative data need to be assembled for each of them. This will be easier for some of the variables than for others. In dealing with an established product, for example, the firm might reasonably be expected to have access to a range of information regarding the variables which it controls such as own price and advertising. What may be more difficult to obtain, however, is information about competitors’ products. On this front, price data can be obtained through observing retail prices, as this information by definition is in the public domain and cannot be hidden. This requires continued market observation, perhaps over a long period of time. Likewise, information about product design changes can be obtained by buying the competitors’ product(s), but this may be expensive if there are many on the market. Confidential, commercially sensitive information such as actual advertising expenditure by competitors and their proposed new products present much more difficult problems in terms of access and may have to be left out of the process altogether. Data on levels of disposable income, population variables, interest rates and credit availability are easier to obtain, for example from government statistics, but other variables are more problematic. How can things like expectations and tastes be measured for instance? In these cases the available data, perhaps resulting from market surveys, may be qualitative rather than quantitative. Some means of conversion need to be found if they are to be included in the regression analysis at all. These are the things which the decision maker needs to keep in mind while collecting and selecting data on the relevant variables. Once the first two steps have been completed, the next stage is to specify the likely form of the regression equation. There are two main forms which are used in practice -the linear demand function and the non-linear or power function. Both treat the demand for the product as the dependent variable, while the independent variables are those which have previously been identified as having an effect on demand. If, for example, the firm had decided that the only variables affecting demand for a particular product with its own price and advertising levels then the linear demand function would be written as: Q = a + bP + cA

Alternatively, under these conditions the exponential (power) function would be written as: Q = a P b^ A c

In each case, the a term represents the intercept of the-line drawn from the equation with the vertical axis. The b and c terms represent the regression coefficients with respect to own price and advertising respectively. These show the impact of each of these variables on product demand. Once they have been estimated it is possible to predict the level of demand for any set of values of the independent variables simply by substituting them into the equation.

where the dependent variable Y is total cost and the independent variable X is total output. If this function is plotted on a graph, the parameter a would be the vertical intercept (i.e., the point where the function intersects the vertical axis) and b would be the slope of the function. Recall that the slope of a total function is the marginal function. As Y = a + bX is the total cost function, the slope, b, is marginal cost or the change in total cost per unit change in output.

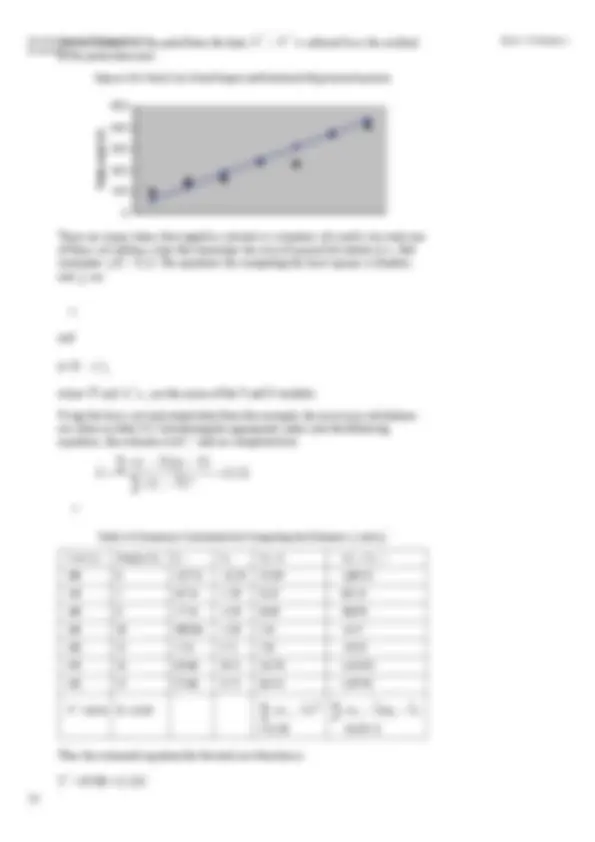

Assume that data on cost and output have been collected for each of seven production periods and are reported in Table 3.2. Note that there is a cost of Rs. 100 associated with an output rate of zero. This represents the fixed cost of the capital input, which must be paid regardless of the rate of output. These data are shown as points in Figure 3.1. They suggest a definite upward trend, but they do not trace out a straight line. The problem is to determine the line that best represents the overall relationship between Y and X. One approach would simply be to “eyeball” a line through these data in a way that the data points were about equally spaced on both sides of the line. The coefficient a would be found by extending that line to the vertical axis and reading the Y-coordinate at that point. The slope, b, would be found by taking any two points on the line, {X 1 , Y 1 } and {X 2 , Y 2 } and using the slope formula

2 1

2 1

Although this approach could be used, the method is quite imprecise and can be employed only when there is just one independent variable. What if production cost depends on both the rate of output and the size of the plant? To plot the data for these three variables (total cost, output, and plant size) would require a three- dimensional diagram; it would be nearly impossible to eyeball the relationship in this case. The addition of another independent variable, say average skill levels of the employees, would place the data set in the fourth dimension, where any graphic approach is hopeless.

Table 3.2: Hypothetical Data on Total cost and Total Output

Production period Total Cost (Yi) Rs. Total Output (Xi) 100 0 150 5 160 8 240 10 280 15 370 23 410 25

There is a better way. Statisticians have demonstrated that the best estimate of the coefficients of a linear function is to fit the line through the data points so that the sum of squared vertical distances from each point to the line is minimized. This technique is called ordinary least-squares regression (OLS) estimation and a number of statistical packages, including excel. Based on the output and cost data in Table 3.1, the least-squares regression equation will be shown to be

Yˆ^ = 87.08 + 12.21X

This equation is plotted in Figure 3.13. Note that the data points fall about equally on both sides of the line. Consider an output rate of 5. As shown in Table 3.2, the actual cost associated with this output level is 150. The value predicted by the regression equation, referred to as Yˆ, is 148.13. That is, Yˆ^ = 87.08 + 12.21(5) =148.13. The deviation of the actual Y value from the predicted value (i.e., the

Introduction to Managerial Economics

vertical distance of the point from the line), Yˆi – Yˆ^ is referred to as the residual or the prediction error.

Figure 3.13: Total Cost, Total Output and Estimated Regression Equation

0

100

200

300

400

500

Total cost (Y)

There are many values that might be selected as estimators of a and b, but only one of those sets defines a line that minimizes the sum of squared deviations [i.e., that minimizes q(Y (^) i -Yi )^2 ]. The equations for computing the least-squares estimators

and

â = (^) Y – bˆx_

where Y and - bˆx_ are the means of the Y and X variables.

Using the basic cost and output data from the example, the necessary calculations are shown in table 3.3. Substituting the appropriate values into the following equations, the estimates â of bˆ^ and are computed to be

i

i i

Cost (Y (^) i) Output (X (^) i) Yi– Xi– (X (^) i – )2 (X (^) i– ) (Y (^) i – ) 100 0 –137.14 –12.29 151.04 1,685. 150 5 –87.14 –7.29 53.14 635. 160 8 –77.14 –4.29 18.40 330. 240 10 –002.86 –2.29 5.24 –6. 230 15 –7.14 2.71 7.34 –19. 370 23 132.86 10.71 114.70 1,422. 410 25 172.86 12.71 161.54 2,197.

=511.40 =6,245.

Thus the estimated equation for the total cost function is

Yˆ^ = 87.08 + 12.21X

Basic Techniques

Introduction to Managerial Economics

made will depend, therefore, on the decision maker’s knowledge or estimation of how a particular future state of nature will affect the outcome of each particular strategy.

Given a set of outcomes, Xi, and the probability of each occurring, Pi, three statistics relating to probability distributions can be used � (^) The expected value or mean is a measure of expected return. This is represented by

=

n

i

1

where P i is the probability and X i is the outcome. � (^) The standard deviation is a measure of risk. This is represented by

2 1

=

n

i

� (^) The coefficient of variation is a measure of risk per unit of money of return.

These statistics have a direct application in measuring the expected return and risk associated with any business decision for which a set of outcomes and their probabilities have been determined. The expected value, standard deviation, and the coefficient will be referred to as risk-return evaluation statistics.

Having defined risk and reviewed some of the related terminology, the task now is to develop quantitative measures of return and risk and to show how they are applied in decision making. We know that individuals have different preferences concerning risk taking. It is also important that such preferences be identified and their effect on decisions evaluated. Rational decision making requires that the expected return be determined and the risk be measured, and that there be information about the manager’s preference for risk. The expected value, the standard deviation, and the coefficient of variation will be referred to as risk-return evaluation statistics.

Let us take an example where two investments, I and II, are being considered. Both investments require an initial cash outlay of Rs.100 and have a life of five years. The return on each depends on the rate of inflation over the five-year period. Of course, the inflation rate is not known with certainty, but suppose that the collective judgment of economists is that the probability of no inflation is 0.20, the probability of moderate inflation is 0.50, and the probability of rapid inflation is 0.30. The outcomes are defined as the present value of net profits for the next five years. These outcomes for each state of nature (i.e., rate of inflation) for each investment are shown in table 3.3.

Analysis of these investments can be made by calculating and comparing the three evaluation statistics for each alternative. The expected value μ is an estimate of the expected return for the investment. Because risk has been defined in terms of the variability in outcomes, the standard deviation s is a measure of risk associated with the investment. The larger the m the greater is the risk. Risk per rupee of expected return is measured by the coefficient of variation ( y).

The evaluation statistics for each investment alternative are computed as follows:

=

n

i

1

Basic Techniques

2 2 2 2 1

=

σ μ

n

i

I Pi Xi

υ 1

1 1 = = =

σ II = 0. 2 ( 150 − 205 )^2 + 0. 5 ( 200 − 205 )^2 + 0. 3 ( 250 − 205 )^2 = 0. 35

υ (^) II = =

The expected return for investment I of Rs.240 is higher than for II (Rs.205}, but I is a riskier investment because sI = 111.36 is greater than sII = 0.35. Also, risk per dollar of expected returns for I ( yI = 0.46) is higher than’ for ( yII = 0.17). Which is the better investment? The choice is not clear. It depends on the investor’s attitude about taking risks. A young entrepreneur may well prefer I, whereas an older worker investing in a retirement account where risk ought to be minimized might prefer II. Generally higher returns are associated with higher risk.

Table 3.3: Probability Distribution for Two Investment Alternatives

State of Nature Probability (Pi ) Outcome(Xi )

Investment I No inflation 0.20 100 Moderate inflation 0.50 200 Rapid inflation 0.30 400 Investment II No inflation 0.20 150 Moderate inflation 0.50 200 Rapid inflation 0.30 250

Some strategic decisions are based on a sequence of decisions, states of nature and possibly even strategic decisions. Alternative strategies can be evaluated then, by using a decision tree, which traces sequences of strategies and states of nature to arrive at a set of outcomes. The probability of each outcome is found by multiplying the probabilities on each branch leading to that outcome.

A decision tree shows two or more branches at each point where a decision or event (state of nature) leads to the various outcomes. The decision tree approach can be directly applied to managerial decision-making. A firm entering a new market may decide to build a small or large plant (managerial decisions). This has no probabilities. But there may be stochastic elements (an outcome determined by chance) associated with each decision e.g., reaction of a major competitor and the economic condition. The competitor may react by starting a national, regional, or a new advertising program. The probability of each occurrence will depend on the size of the plant.

The possible economic conditions and then probabilities may be recession, normal or boom. Here also the probability will depend on the size of the plant. The probability of each combination is found by multiplying the probability along each of the branches leading to the outcome. For example, if the manager decides to build a large plant there is a 70 per cent chance that the competitor will respond with a

in a stock. The greater the number and range of outcomes, the greater is the risk associated with the decision or action. Uncertainty is a situation where there is more than one possible outcome to a decision but the probability of each specific outcome occurring is not known or even meaningful. This may be due to insufficient information or instability in the nature of variables. In extremes cases of uncertainty, the outcomes may itself be not clear. Decision making under uncertainty is necessarily subjective.

The Risk Faced by Coca Cola in changing its secret formula.

On April 23, 1985, the Coca Cola Company announced that it was changing its 99- year old recipe for Coke. Coke is the leading soft drink in the world, the company took an unusual risk in tempering its highly successful product. The Coca Cola Company felt that changing its recipe was a necessary strategy to ward off the challenge from Pepsi - Cola, which had been chipping away at Coke’s market over the years. The new Coke, with its sweeter less fizzy taste, was clearly aimed at reversing Pepsi’s market gains. Coca Cola spent over $. 4 million to develop its new Coke and conducted taste tests on more than 1,90,000 consumers over a three-year period. These seemed to indicate that consumers preferred the new Coke by 61 percent i.e. 39 percent over the old Coca Cola - Cola then spent over $ 10 million on advertising its new product.

When the new Coke was finally introduced in May 1985, there was nothing short of a consumers’ revolt against the new Coke, and in what is certainly one of the most stunning multimillion dollar about faces in the history of marketing, the company felt compelled to bring back the old Coke under the brand name of Coca Cola Classic. The irony is that with the Classic and new Cokes sold side by side, Coca Cola regained some of the market share that it had lost to Pepsi. While some people believe that Coca-Cola intended all along to reintroduce the old Coke and that the whole thing was part of a shrewd marketing strategy, yet most marketing experts are convinced that Coca Cola had underestimated consumers’ loyalty to the old Coke. This did not come up in the extensive taste-tests conducted by Coca- Cola because the consumers tested were newer informed that the company intended to “replace” the old Coke with the new Cola, rather than sell them side by side. This case clearly shows that even a well conceived strategy is risky and can lead to results estimated to have a small probability of occurrence. Indeed, the failure rate for new products in the United States is a stunning 80 percent.

3.12 ROLE OF MANAGERIAL ECONOMIST

In general, managerial economics can be used by the goal-oriented manager in two ways. First, given an existing economic environment, the principles of managerial economics provide a framework for evaluating whether resources are being allocated efficiently within a firm. For example, economics can help the manager if profit could be increased by reallocating labour from a marketing activity to the production line. Second, these principles help the manager to respond to various economic signals. For example, given an increase in the price of output or the development of a new lower-cost production technology, the appropriate managerial response would be to increase output. Alternatively, an increase in the price of one input, say labour, may be a signal to substitute other inputs, such as capital, for labour in the production process.

Thus, the working knowledge of the principles of managerial economics can increase the value of both the firm and the manager.

Introduction to Managerial Economics 3.13 SUMMARY

Various quantitative tools are used by the manager to help him in making decisions. An opportunity set is a set of alternative actions which are feasible. Variables are things which can change and can take a set of possible values within a given problem. A function shows the relation between two variables. It can take different forms-linear, quadratic, cubic. Partial derivatives are functions of all variables entering into the original function f(x). Optimisation is the act of choosing the best alternative out of all available ones. Regression analysis helps to determine values of the parameters of a function - Economic analysis of risk becomes crucial with reference to decisions.

3.14 SELF-ASSESSMENT QUESTIONS

Market A Market B Price Quantity Price Quantity 50 400 60 600 40 600 50 800 30 900 40 1100 20 1000 34 1400

[Hint: First get total revenue in each market by multiplying price with quantity.]

3.15 FURTHER READINGS

Koutsoyiannis, A., Modern Microeconomics, Macmillan.

Baumol, W.J., Economic Theory and Operations Analysis , Prentice Hall of India.

Peterson Lewis, Managerial Economics , Fourth Edition , Prentice Hall of India.

Basic Techniques