Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Material Type: Quiz; Professor: Boal; Class: PRINCIPLES OF MICROECONOMICS; Subject: Economics; University: Drake University; Term: Summer 2008;

Typology: Quizzes

1 / 6

This page cannot be seen from the preview

Don't miss anything!

Principles of Microeconomics (Econ 2) Signature: Drake University, Summer 2008 William M. Boal Printed name:

INSTRUCTIONS: This quiz is closed-book, closed-notes. Simple calculators are permitted, but graphing calculators or calculators with alphabetical keyboards are NOT permitted. Numerical answers, if rounded, must be correct to at least 3 significant digits. Point values for each question are noted in brackets. Maximum total points are 100. I. Multiple choice: Circle the one best answer to each question. [3 pts each: 39 pts total] (1) If the government wants to raise the price of corn it should try to shift a. the demand for corn to the right. b. the supply of corn to the right. c. either (a) and (b). d. neither (a) nor (b) will raise the price of corn. (2) Suppose a change in security procedures increases the time that travelers must spend in airports. By itself, this would shift a. down the supply of air travel. b. up the supply of air travel. c. down the demand for air travel. d. up the demand for air travel. (3) Suppose it is illegal to sell a certain good. If caught, the seller must pay a $500 fine. The probability of being caught is 2%. The expected punishment cost is therefore a. $2. b. $10. c. $50. d. $500. e. $1000. (4) Currently, the price of sugar in the U.S. is much higher than in other countries, but the U.S. restricts international trade in sugar. If free international trade were permitted, the U.S. would a. export sugar. b. import sugar. c. be self-sufficient in sugar. d. cannot be determined from the information given. (5) Recently, the demand for petroleum in Asia has shifted right. Since petroleum is traded internationally, this should cause the price of petroleum in the U.S. to a. rise. b. fall. c. remain constant. d. cannot be determined from the information given. (6) The price of rice in some Asian countries is higher than the price of rice in the United States. If these countries end their restrictions on international trade in rice, this change will benefit a. Asian rice producers and U.S. consumers. b. U.S. rice producers and Asian consumers. c. U.S. rice producers and U.S. consumers. d. Asian rice producers and Asian consumers. (7) Arbitrageurs buy low and sell high because they are trying to a. ensure that all consumers face a fair price. b. make money. c. enforce the Law of One Price. d. keep markets orderly. (8) Arbitrage will not guarantee that people in Des Moines and Seattle pay similar prices for a. Euro currency. b. government or corporate bonds. c. gold. d. houses. (9) Suppose the price of potatoes in Des Moines is $1. per pound and the cost of shipping potatoes between Des Moines and Detroit is $0.30 per pound. The market is in equilibrium if the price of potatoes in Detroit is a. $0.30 per pound. b. $0.70 per pound. c. $1.40 per pound. d. $2.00 per pound. (10) Suppose the supply of a good is plentiful today but is expected to be scarce in the future. Speculation through buying and holding inventories will tend to a. raise the price of a good today and lower it in the future. b. reduce the quantity demanded in the future. c. encourage greater consumption today. d. all of the above. e. none of the above.

Drake University, Summer 2008 Page 2 of 6 (11) Suppose a certain natural resource in limited supply can be stored at no cost. Assume speculators are active in the market for this resource. In equilibrium, the price of this natural resource is expected to a. remain constant. b. grow at the same rate of return as alternative investments. c. fall at the rate of interest. d. shoot up sharply when most of the resource is gone. (12) Suppose for some reason the futures price of petroleum for delivery next December were $120, but you believed that the spot price would be $100 next December. You could make money by a. selling petroleum futures now and selling petroleum on the spot market in December. b. buying petroleum futures now and selling petroleum on the spot market in December. c. selling petroleum futures now and buying petroleum on the spot market in December. d. buying petroleum futures now and buying petroleum on the spot market in December. (13) Suppose the price of a share of stock in Ginormous Corporation today is $50. We know that speculators are already active in the stock market. Assume that the stock market is in equilibrium. Then speculators must believe that the price of a share of stock in Ginormous Corporation tomorrow will be a. greater than $50. b. less than $50. c. about $50. d. cannot be determined from the information given. II. Problems: Insert your answer to each question below in the box provided. Feel free to use the margins for scratch workonly the answers in the boxes will be graded. Work carefullypartial credit is not normally given for questions in this section. (1) [Time costs: 12 pts] Commuting by bus takes 1 hour round trip but the fare is only $2. Commuting by car takes only 1/2 hour round trip, but the money cost (including parking, gasoline, and maintenance) is $10. Suppose someone values her or his time at $10 per hour.

e. Which mode of commuting is the person likely to choose--bus or car? f. If another person is indifferent between these two modes of commuting, what must be the value of their time?

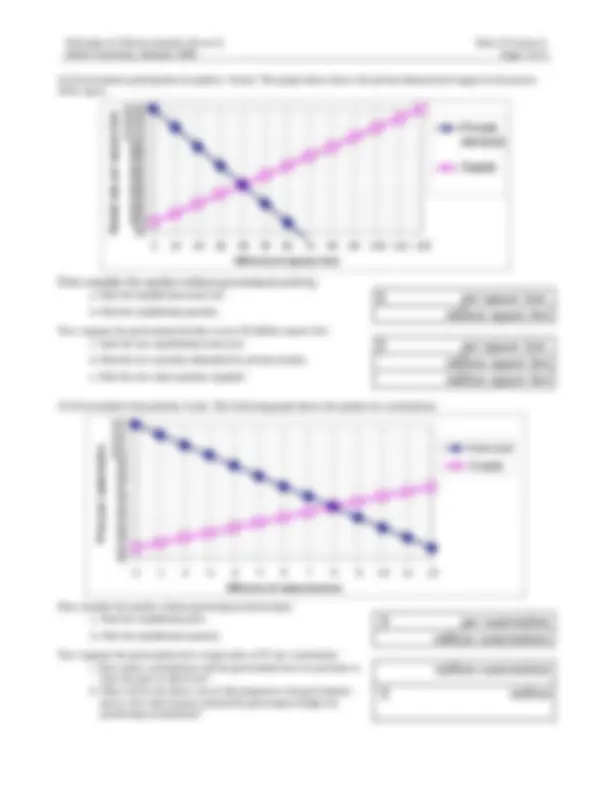

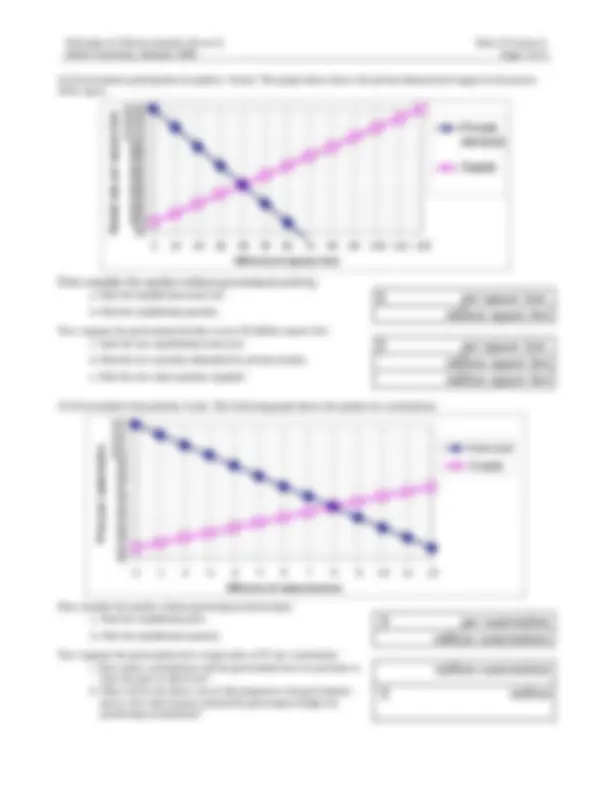

Drake University, Summer 2008 Page 4 of 6 (4) [Illegal activities: 8 pts] The graph below shows the market for a kind of illegal weapon in the absence of any government intervention. Suppose it now becomes illegal to buy (but not illegal to sell) this weapon. Enforcement efforts are such that each time a buyer buys a weapon of this kind, she or he faces a 5% chance of being caught and having to pay a $4000 fine. $

Quantity (thousands) Price

d. How much money can the government expect to collect in total fines, on average?

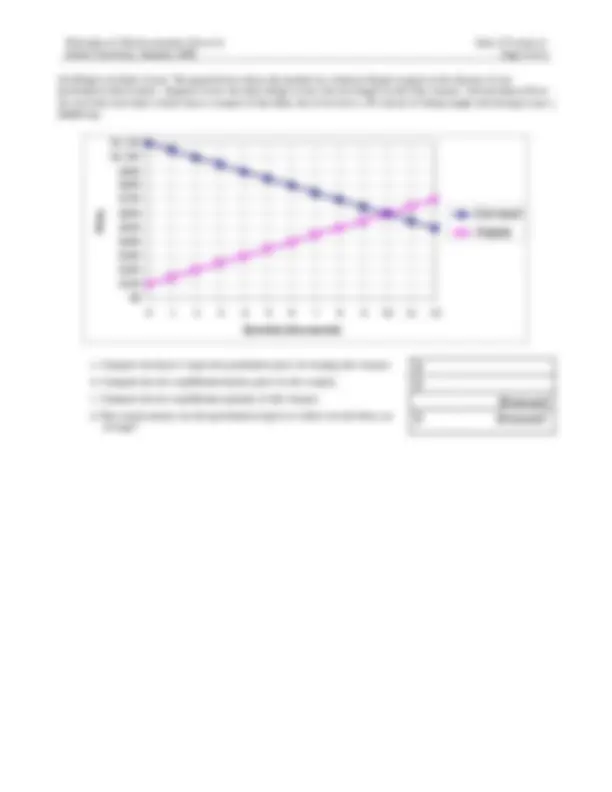

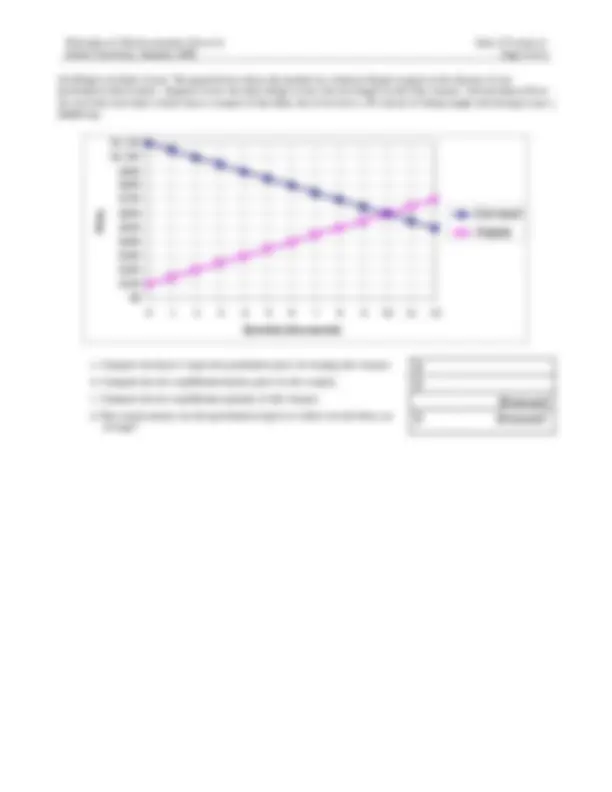

Drake University, Summer 2008 Page 5 of 6 (5) [Effects of international trade: 18 pts] Country X and Country Y both have markets for grain. Supply and demand schedules for the two countries are given below in millions. Country X Country Y Price Quantity demanded Quantity supplied Quantity demanded Quantity supplied

First consider the outcomes under autarky (that is, no international trade).

Now consider the outcomes with free international trade between Country X and Country Y.

d. Which country exports grain?

f. Grain consumers in Country X g. Grain producers in Country X. h. Grain consumers in Country Y. i. Grain producers in Country Y.