Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Templetoti U.S. Dollar Liquid Reserve Fund. Templeton U.S. Value Fund. Franklin Templeton Investments Office Directory. 3. 5. 6. 8. 19.

Typology: Study notes

1 / 232

This page cannot be seen from the preview

Don't miss anything!

Unaudited Semi-Annual Report

FRANKLIN TEMPLETON

I NVE STME NTS

societi! d'investissement a capital variable

U N A U D l T E D S E M T - A N N U A L R E P O R T

FOR T H E S I X M O N T H S E N D E D D E C E M B E R 31, 2 0 0 7

This report shall not consLitute an offer or a solicitation of an offer LO buy shares of Franklin Templeton Investment Funds (the

"Company'.). Subscriptions are to be rnade o n the basis of the current simplified prospectus accompanied by the current full

prnipec[us and its addendum. a copy of the latest available audited report and, if published thereafter, the lares[ unaudited

senii-annual report.

sociktk d'investisscaicnt i capital variablc

G E N E R A L INFORMATION ( a s at December 31, 2007)

26. boulevird K A I. L.-244Y I.uxenibourg. Grand-Duchy of Luxeiiibourl: (Registered with the registre de coiniiierce et des societes, Luxciiiboorg, uiidrr number H 35 177)

Chairman The H~71iorableSichnlas F. Brady Cheirrri,iri , i d Chief Fwcurive Offierr CHOPIANK PAR-hEfi:, INC 16 Nura W;rsning:un Sirect Eairnii. MD 2 :hOl. I. ~. L .

Directors Ri(h;lrtl H Frank Managing Direc:or D.-\RBY OVERSEA5 ISVESTMENTS LIMITED

A h i r k G. Holoivt~jho Prcsiden: TLLIPLETON CAPl.lAL ADVISORI: LlZll~lED F.0 Rnx U-7779, Wts: Rdy Srree;. Iyford C+. liassau. Bahamas

P:e;ident and Chiel Executive Otticer 'LSIA 5ECI:RITIFS G1.ORAI. IIMITFD 18 tiarcour: Road. Room 2481. Tower I Admiralty (:enre; I loag Ki.irifi

1 CONDUCTING OFFICERS:

, (;rand-Duchy nf I:.iwniI>mirg

Willicrm Lcdwuotl 2 c 5 ,t>oulcwtd Roy,il. I. 2-t49Luxembuurg

Dcnisr Vta.< 26.hvulc~arrlKuyal. L-L.t.tY Luxembourg Grand-Duchy of L~ixciiibou:g

REGISTERED OFFICE: 26.ho:ilward Roynl. 1 -2++9Luxcmboilrg Griirid Duch) c i l Luxcmbuure,

PRINCIPAL DISTRIBUTOR: TEMFLETOS L.OR.41. ADLTSORS 1 IhZITEt) P 0 Box l i - i i 5 9. Lyford (:a).. Nassaii. Rahani(is

INVESTMENT MANAGERS: A S i o Fr~iikliiiMutual^ Beacon^ Fund, Franklin \1urual Global Discover). Fund : Templeton Euroland Bond Fund Ternplerun Euroland Fund, Tenipleron Euro I.iquid Reserve Fund; Templeton European l.unrl: Templeron European T d Rerum Fund+: Templeton (;lobal (Euro) Fund, Templeton Global BaLrnccd FuridS , Tcmpleron Global Equiry Income Fund, Templeton Glohal Fund: and Templeton Global Smaller Ccirnpanies Fund

l7lL4NKLlli TCMLPLETOK INVESTMFUT \fAUAGFblFUT 1.IMITED 5 \ h n s n n k e e t Edirihurgti Et13 8HF1. Sco:la:id L K.

Investment hlanager in respec1 ol the equity puruun c i l [tic iisscis of :he Tvrnplemri Global Ralanccd Fund & 10. Tcrnipl~~i:i Asian G r o w h Fund, Teniple:o:i BRIC: Fund; Tcmple:on Lhina Fund : Templeion Fasrem Europe Fund, Templeton Emerpiig blarkel> Fund: Teinplcron F n w p g \tarkets Smaller Companies Fund Templeton (;loha1 Income Fund*, Templeton Japan h n d : Templeron Korea Fund, Templeton L a m Americ.i Fund, arid Terripletcin Ttiailiirirl Fund

TEMPLETON XSSET \tANAGEMEliI LID i Tcmawk Uoulewrd t 38-03 Sunrec Tower One Singapore n38Y 87

Tcmpleron. 4 w t Management Ltd has been appointed as Investment Manage: in respect u! lhc equiry poruori of [tie &xrs til [he Ternplvron Global Incnnw Fund IO Franklin Aiian Flex Cap Fund, Franklin Biotechnology D i x u v c r y I'unrl , Franklin High Yield Fund Franklin Hiqh Yield (EKo' Fund, Franklln In~onieFund, Franklin India Fund, Franklin liatural Resources F u n d , Frxikliri Srraregic Incotne Fund Franklin Technology Fund: Franklin I! S Equity Fund;

Frmklin V S G r o w h Fund, Franklin L S 0 portunities F~iiid Triinkli:> I: S L!cra Shorr Bond Fund. Franklin L S Small-hIid Cap Growth FuxI:

Franklin Templeton Global Fundamental Stratryes Fund; Franklin Tcmplrron Globdl Glowrh and Value Fund : Templeton Asian Bond F;lnd : Terriplemn Emerging hlarkes Bond Fund, Tvrnpleri.iri Furopeon Tnral Rcriim Fii:id* , Templeton Global Balanced F~ind' , ~lemplctonGlobal Burid (Euro: ruricl: Templeron Glohal Bond Fund, Templeton Llohal High Yield Fund, Templeton Global Income FundB : Tcmplcrtrn Cliibal Tim1 Rerum Fund , and Templeton IJ 5. Dollar Liquid Reserve Fund.

One Franklin Parkw San M a w. CA 94403-1906. L' 5. A

rrxikliri Advisers, lric has appoir~td Frarikliri Terripltwn Invt~srrrierrr Managemenr Limited as suh-advlsor in relation to die Temple:on EUI-oland kind h n d. h n k l i n Templeton Investment M;in;rgcment Limited and Franklin Temple~un Irisu1uuon;il. LLC AS sub-ddviwrs i r i reliltion 10 thc Trmpleron (;lohal Toral Rerum Fund and Franklin Templeton :\sser Manapient (hd13? Private Limited as sub-adxisor in relation to the Franklin .hian Flex Cap h n d and the Franklin 1:idia Fund

G E N E R A L I N F O R M A T I O N ( a s at December 3 1 , 2007)

.I: Franklin Adxkrs. Inc has h e m appoinred '3:: Cn-Invesrnwni \f;inager of riie T.irid. rugether u i t h I'irluciap- .TyLastCompany ot Canada

Fund. rogrher t \ ~ r! i Frerikliri Tcrriplelm lrivotmt.

$ Fraakliri Ad,iwr>, lric has bccri appointed as lnvexmcnt Manager in respect of [he fixed incorrit' puraori ul the i w e t s uf Templctun Gluhil lncurrie Fund

& IC>. Franklin European Growth Fund: Frmklin Furopea:i S m e l l M i d Cap Gronth Furid, I-rmklin Global C;row!i Fund Fra!iklin L l o h a l Real Fs:a;e (Euro) Fund , Franklin Global Real E s x c (I!SD! Fund: Frd:ikliri Glubal Small-Mid Cap Gruu-th Fund; Templeton (;lohal Ahsolute Re:uni (Euro! Fund , and Ternpletori Global Absolute Ke:um iCSU) h n d.

,G LU Templeton Gron:h (Euro) Fund

TEWLFTON GLOtlAL .4DVISOKS LlMlTED F 0 Box N- 1,yfurd ( y a y , Nassau. tfiihamas

A 5 to: Templeron I! 5 Value Fand

FR4NKLlfi TEhIPLE-rOfi INL'E5TYIESTS CORP 1, Adelaide Srreer Fast. Suire 2101 Toronro ( h a n o MiC 3RR. Caiixla

pis to: Franklin Mutual Beacon Fund*, Frmkliri Mutual Eurupean Fund, arid Franklin \luriial Glohal Discover). Fand

101 John F Kennedy Parkwa) Short Hills. NJ 07078-2789. 11.5 A

*Franklin Vurual Adwers. 1.1.C has been dppmnred JS Co-lnvesrmenr Manager lor these hinds. together n-i:h I-ranklin Iempleum Investment h2an;igcrnent I.imired

As r n Frmklin Terrrple:o:) J J ~ W ~ Fund

FR,\fiKLIN TElrlFLETON ISVESTMENTS JI\FAY LIMITED Kancmatsu Building. 6th Floor 14-1, K y i b a h 2 - chume Chuo-Ku. Tokyo. Jdp3n

.45 to Franklin Templeron (;loha1 Fundamental Strategies Fund*

FIT)I!C.IARY THYST COMPANT or C-\NAI)A 200 King Street West 5:ilre 1700 Toronto, On:ano M511 3T (Z3:ldd;I

Fiduci;try Trllsr Corripari~o i Ca:i,~ds lids bet:) ;ippoinred '3s C~>,-Invrsrmenr htanager of ;his Fund. togethci- mith Franklin Adnsers. Inc.

CUSTODIAN, LISTING A G E N T A N D PRINCIPAL PAYING A G E N T :

Furopcan Rank ~ n dRasiness Cenrre 6 Roure de Treves, 1.2633 Senningerherg Grand-Duchy ul Luxembourg

J F. YIOR(i.4L BALK LUNE!dBOLRG S A.

REGISTRAR A N D TRANSFER, CORPORATE, DOMICILIARY A N D ADMINISTRATIVE A G E N T :

16, boulevard Koval. L-2449 Luxcmbuurg Grand -Duchv (3 i.uxembourg

AUDITORS: FKICEL'VATEKI IOL!SKOOPEK< 5 a r I. Ritiseur d.entreprises

FF!AfiKLIN TEIIFLETON ISTERYATIOKAL SERVICES S ' 1

LEGAL ADVISERS: ELUiiGEK, llOSS br P K G S E N 2, place Winsron Churchill. B F 425. 1.-2014 1.iixeinhour~ Grand-Duchy 01 Luxembourg

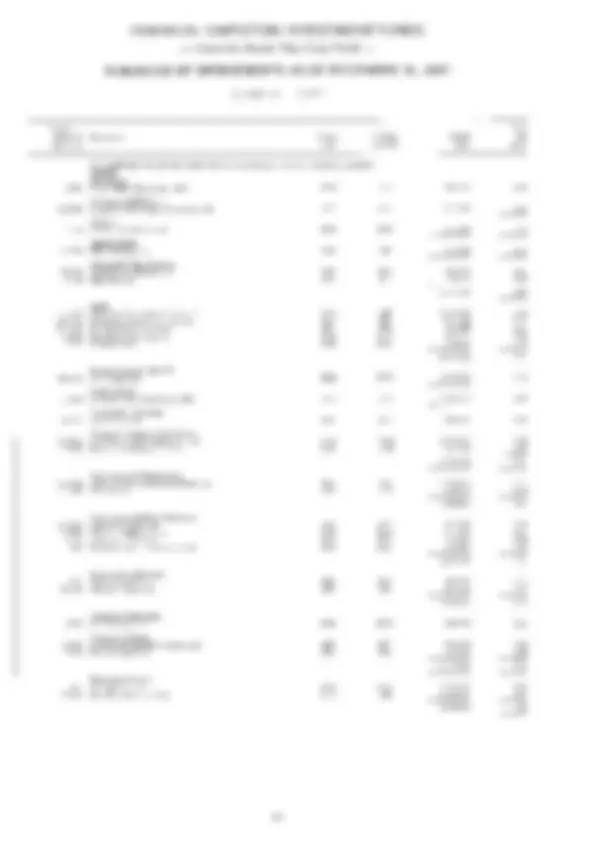

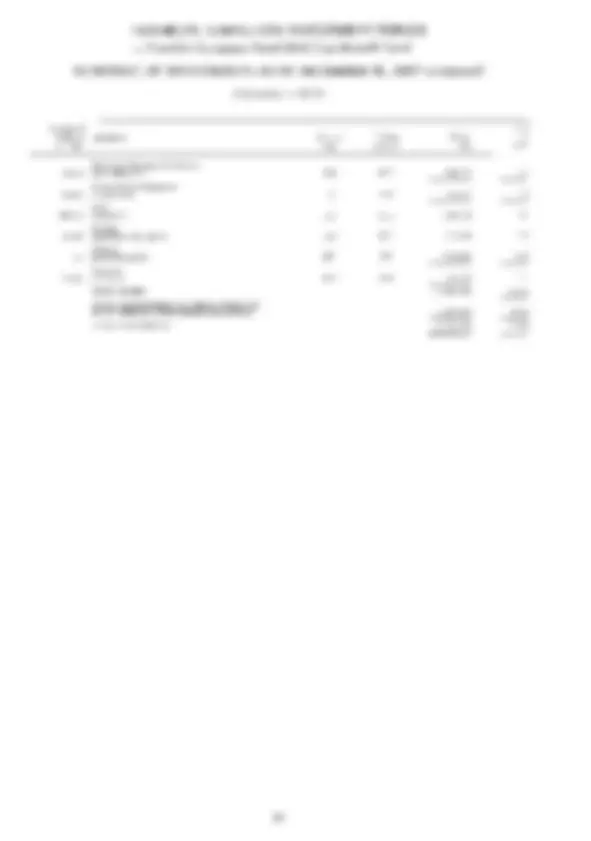

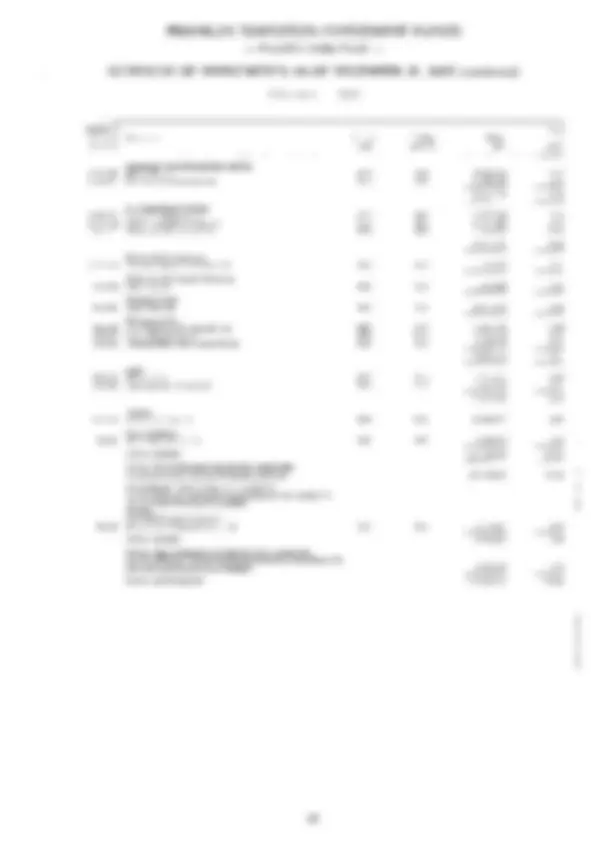

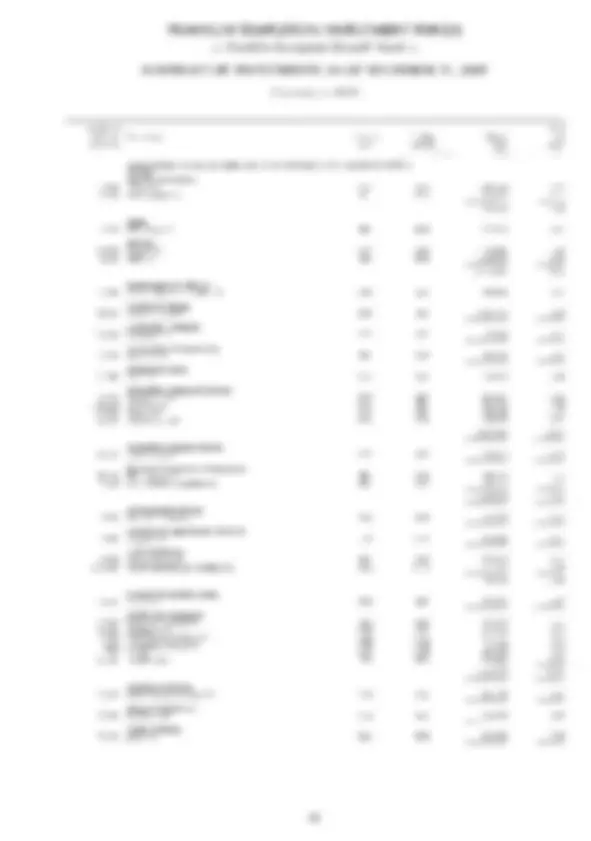

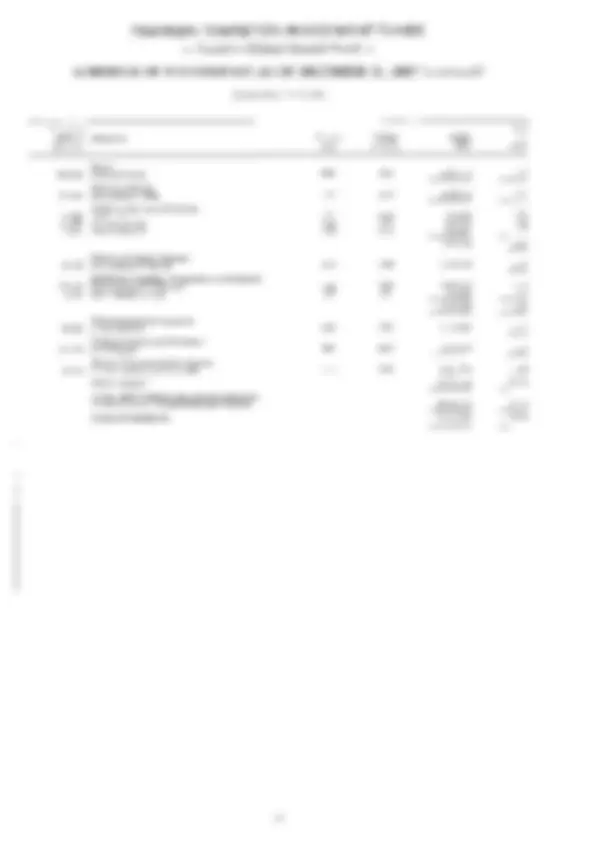

F U N D P E R F O R M A N C E IN BASE C U R R E N C Y P E R C E N T A G E C H A N G E TO DECEMBER 3 1 , 2 0 0 7

s % s 'b % 'b

Franklin Biotechnology Discovery Fund 03 Apr 00 USD (4.5) (2.2) 5.0 66.2 - (14.4)

Franklin Cilohal^ Growth Fund^29 Dec^00 IJSD^ 6.2^ 18.9^ 62.0^ 124.1^ -^ 29.1^ I

Franklin Cilohal Real Estate (Euro) Fund 29 Dec 05 EIJR (13.3) (14.0) - - - 4.

. - -. _.-.

Franklin High Yield Fund 17 .Apr 00 LJ5D - 2 2 1 2 4 541 4 4 4 7 6 8

Franklin Income Fund 01 Jul 99 USD (0.9) 3.6 21.0 76.6 - 85.

1:ranklin Strategic lnconie hind 1.2 Jul 07 LSL) - -

Franklin L S. Equity Fund 29 ,4ug 0.3 USD (2.4) 5.4 16.2 63.1 - 67.

Franklin U.S. Government Fund 07 Jul 97 USU 5.4 5,7 11.2 15.9 5 5 0 110.5 '

1:ranklin U.5. Growth Fund 03 Apr 00 USD 0.6 8.0 15.6 - - 31.

Franklin U S .Ultra Shoi-t Bond Fund 01 Sep 00 I!SD 1.5 3.8 10.1 - - 12.

Franklin U.S. Small-Mid Cap Growth Fund 25 Oct 05 US13 (3.2) 8.3 26.5 94.6 - 22.

Franklin Templeton Cilohal Growth B Value Fund 29 Aug 03 U5D 3.5 14.7 56.4 132.8 - 121.

Templeton Asian Bond F m d 25 Ocr 05 USD 1.8 6.7 - - - 30.

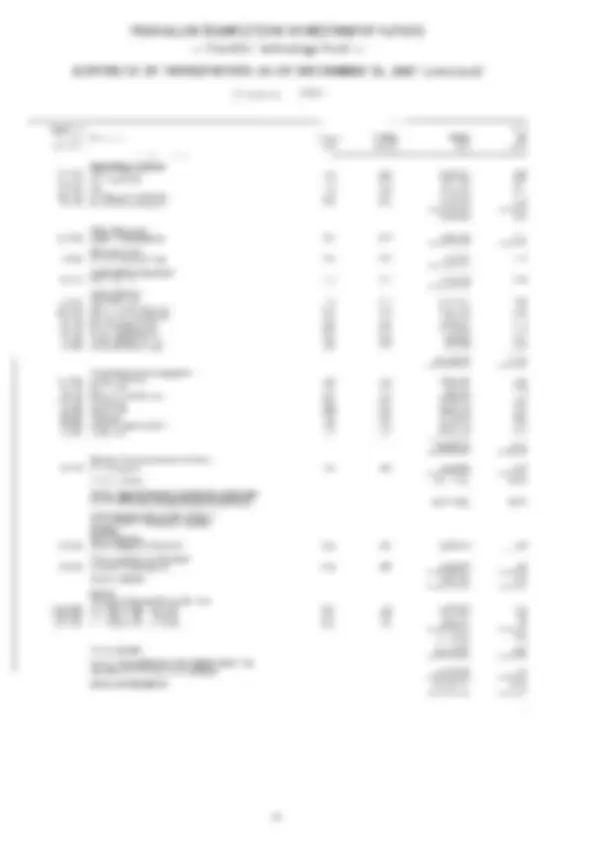

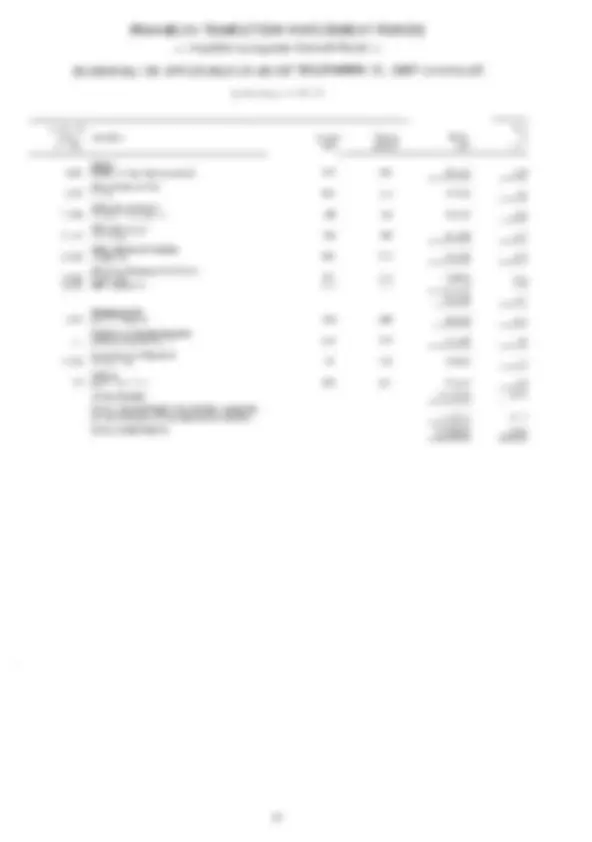

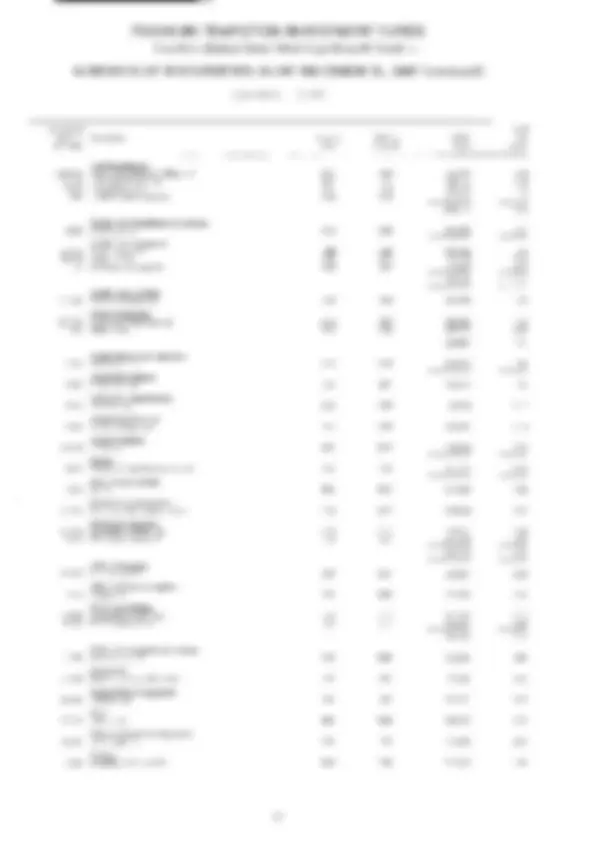

F U N D P E R F O R M A N C E I N B A S E C U R R E N C Y P E R C E N T A G E C H A N G E TO D E C E M B E R 3 1 , 2 0 0 7

launch Base 6 I 3 5 I O Since D ~ L C Currency Months Year Years Years Years Launch 1% s R %, % ')

Templeton Emerging klarkets Bond Fund 28 k b 91 US11 2.0 8.3 30.4 77.3 137.3 428.

Templeton Lmerging^ Markets^ Smaller^ Companies Fund^ 18 Oct 07^ USD^ -^ -^ -^ -^ -^ (0.6)

Templeton Euroland Fund 0 8 J a n 99 EUR (10.8) ( : , 3 ) 45.8 106.5 - 88.

.l.zmpleton I:uropean h n d 17 ,4pr 91 EIJR * (4.2) 7.0 50.0 167.3 143.2 33L7.

Tcmplcton European Total Return Fund 29 Xug 03 EUR (0.7) 0.2 4.6 - - 13.

-l.empleton Global I:und 27 Map 05 U5D - 9.2 46.6 138.6 104.5 298.

Templeton Global (Euro! Fund 28 Fch 91 FUR (9.1) (3.6) 32.4 69.4 52.2 239.

I empleton Global Absolute lietuni (USL)) 1:und 12 Jul 07 USD - - -^ - - 0.

Dzra source Perlormancc - Franklin T e m p h r i I I ~ \ Y S L I I ~ ~ I I ~ S

are no^ in issue. Class A at:c:ii:nii;arion "Aiacc).. $hares arc shown Inlomation on othei- Share C:lasscs 15 available on request. This repoi-t docs not con5tituLe or lorm part ol an!; olkr of shares or an invitation to apply [or shares SuhscCpLions art. LO he rradc on the tiasis ol Lhe current s:mp;ilicd ptospectus iicco:npan:ed by the currcrit full prospccLus and its adderdum. a copy of the latest availahlc audiLed repurt arid. if published thereaher. h e

1

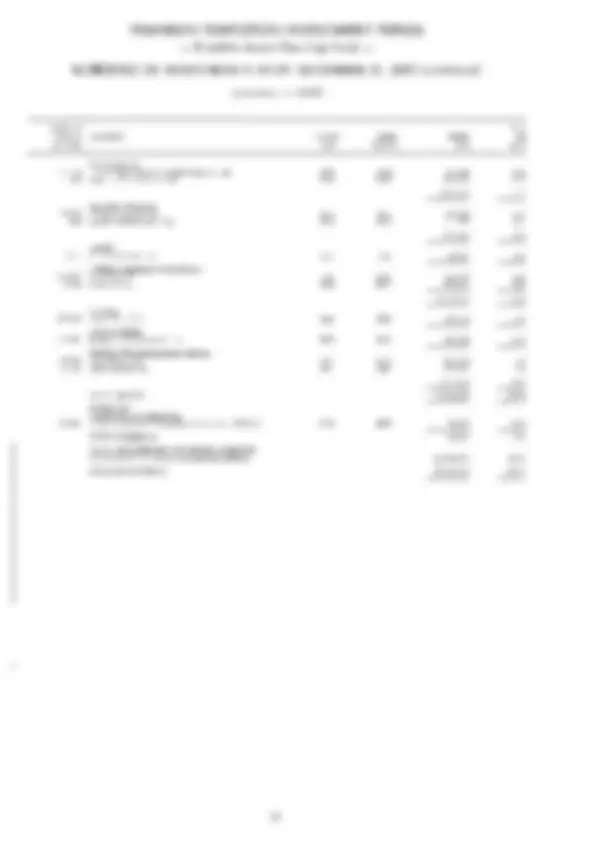

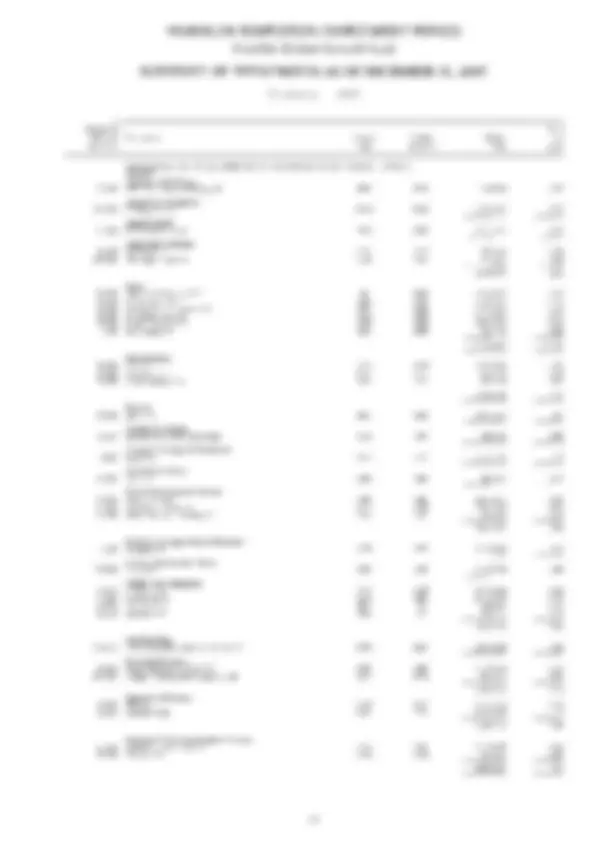

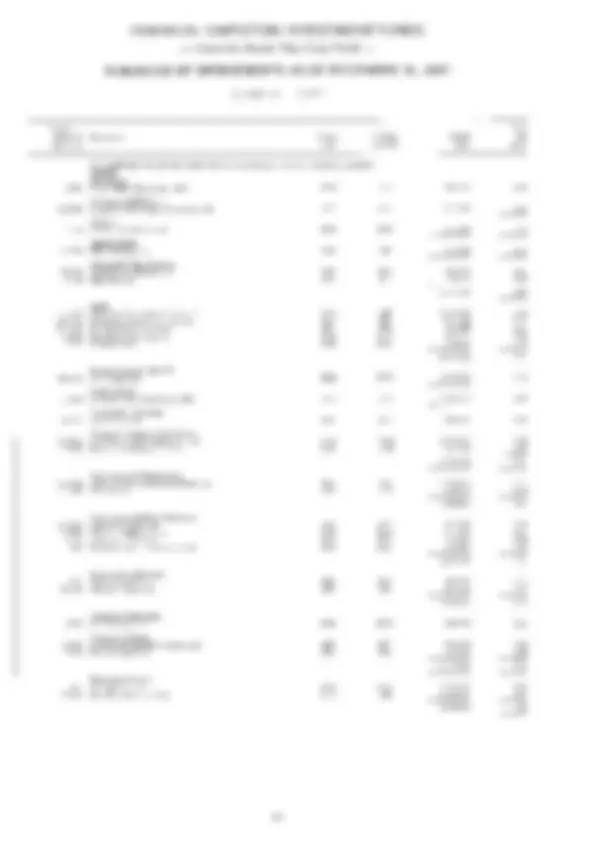

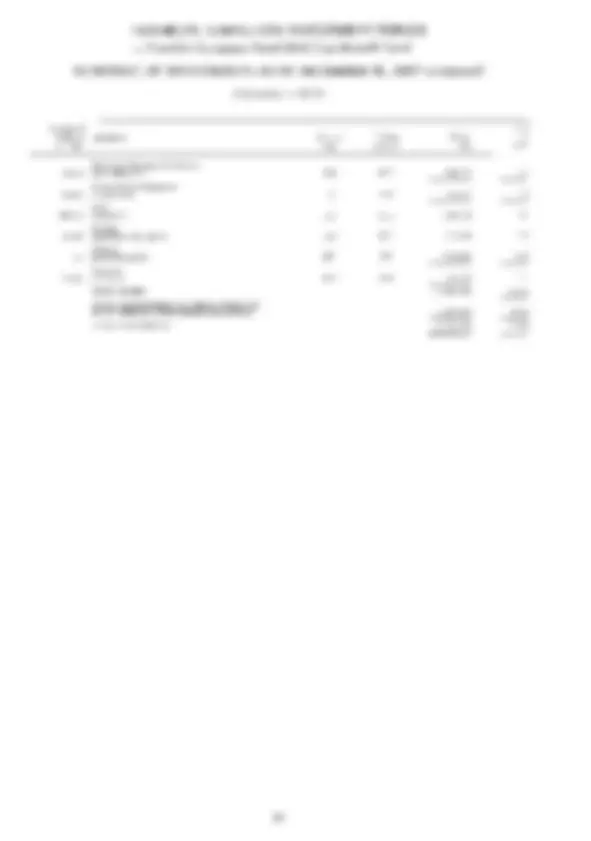

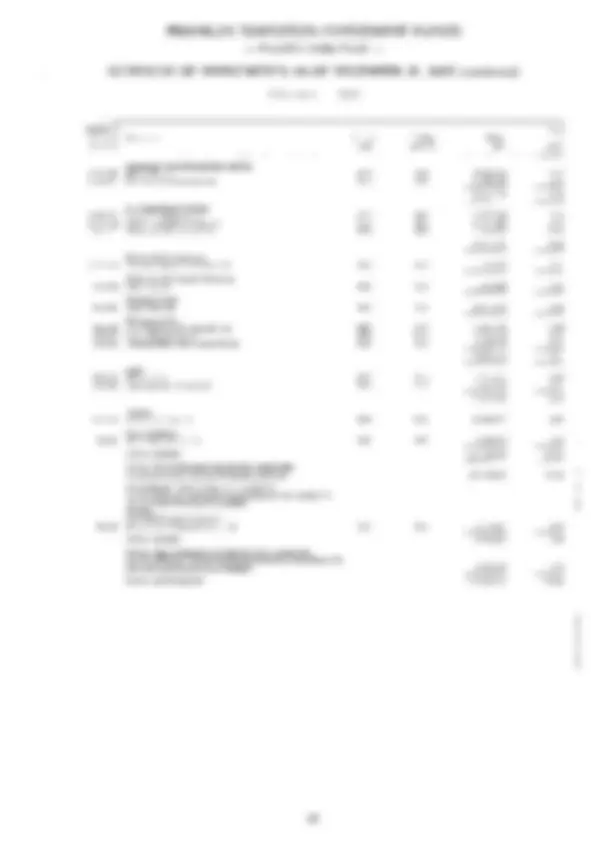

STATEMENT O F NET A S S E T S A T DECEMBER 3 1 , 2007 ( c o n t i n u e d )

Glo3al Eecrl^ Estote^ KPO!^ Estate^ SrrullMid^ Cup^ High^ Yield^ tiigh^ Yield^ .ric3r?e C;rcw*h (^) [ E i i ro) :LSDj GlOWtJi Fund [Eurs) Func Furid Furid Fu-C Fund Fund

38.505. f h 4 8 1.;35.

3 2 l. l l 2

37,966,

2 ,625,

10,o 14

53.712.

909,

368, 893

29, 552

2.082,494, 3,195.

86, 2,364, 47.026.

6,

(ELK1 jlJSD;

308.460.577 742.397. 3.996 2.902. 645.000 13.930. 15,310 30.154. 3.420.465 3.334. 6.198.569 8.030.

217,

60,

6,716 - IT.935. 13.960.948 2.167.782 3.743.

SL,.i30 33.810 44.1 I2 18.049^ 1,478,410^ 210,775^ 567.I .i4 $ 9 5 34.773 72.925 22.810 1,616,843 263.083^ 9 13, 891.732 435. I F 500.191 264.834 17,062,917 2.641,640 23. I 58.

IUSDi 34.623. 32,801, 8.869.

jFLSi lOO.YO6.

STATEMENT OF NET ASSETS AT DECEMBER 3 1 , 2007 ( c o n t i n u e d )

Franklin Franklin Franklin (^) F:crnkk Franklin

F L ~ Resources IlIcull’e Fund Fund Fund* Fund * *

Cash Time deposits arid repurchase agrcemcms (note 19) ,lmounts I-eccivable or. salt. of in\estnienLs Amuuriis receivable or. subscriptions Interest atld dividerids rcccivahlc. neL Other receivabies Unrealised prokt on lotward foreign exchange cont WLS (note 4)

Option contracts at market valut. (note 8 )

36.550.000 - -

19O.hL9.73 1

Amounis pay-able on redemptions Bank overdraft Ur.realiSrd loss on fonvdrd kireign exchanxe contracts (notr 4) Utmahsecl loss on cred.t d d a ~ d ~swaps (now 5 )

L!nrealised ioss on finar.cia1 luture contracts (now 7 )

Taxes arid expenses pa).ab;c

J u n e 3 0. 2006 June 30. 2005

The accompanyg notes tbmi an integr

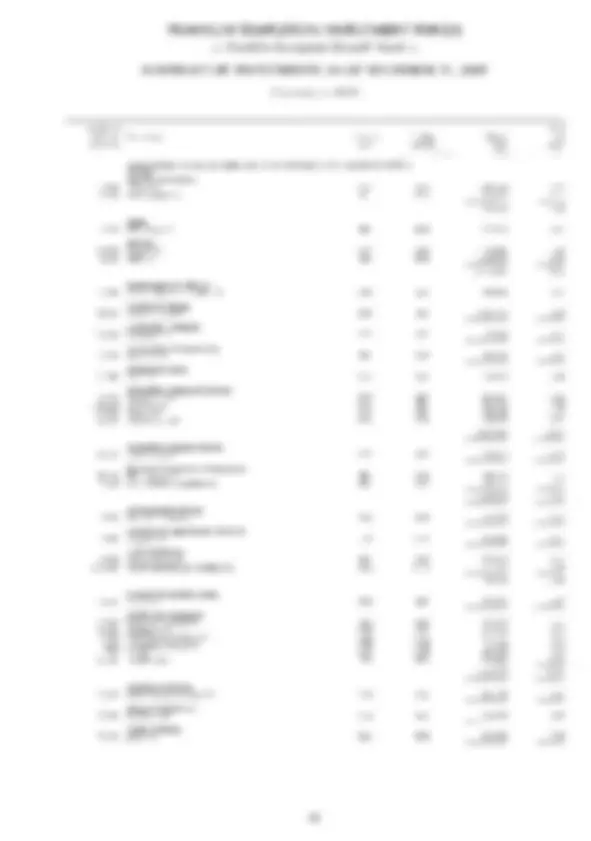

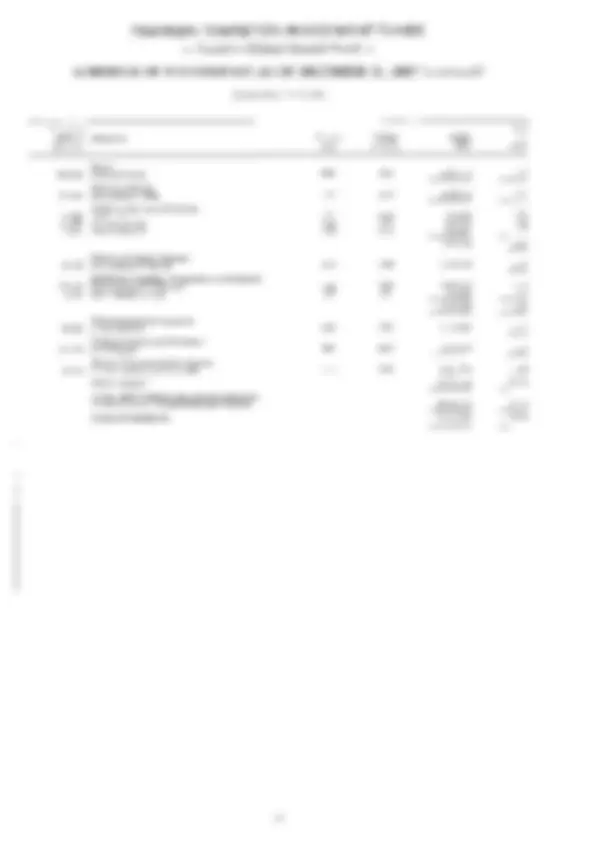

STATEMENT OF NET ASSETS A t D E C E M B E R 31, 2007 (continued)

Frunkliri Mutiinl European Furid

F,uriklin Fru? kli:. Franklin M L I :! L l Terrpleton (^) Ternpleton Glohni Glohnl Globol

Fund Strote@es F w d ' Fund IUSD) iLSD) IUSDI ASSETS Investment in securiries ;it :narkrt valur (notr 2(hl) Cad: Time dcposiis 3rd repurchase agreements [note 19) Atnoums reccivatile un salc of ir.'cstrncnLs Amounts receivable on subscnpr1or.s Interest and dividends receivable. tier Other receivables I!nrealiscd profit on forward foreign exchange contracts (note 4) Unrealised p r o h o n [inancia; fut urr contracts (noie 7) Option conrracts ai rnarker ~ a l u c .(note 8 )

19.l46. 5.215.

136,

2.444. 5,055,251.285 576.416.961 25.052.

Amounts payzhle on purchases ol investments Amuunls payahk on redemptions Bank overdraft Lwealised loss on forward loreign euchxge contracts (cote 3) Lr,reahsed loss on credit delatih swaps inotr 4) Lrrealised loss on interest rate swaps (nore 6) Utire;ilisecl luss on linancral future contracts (noic 7) Investmeni inanagemetir fers p d ). h k (nore 3 ) .Iaxes and cxpcnses payable

4.082. 4,097, 34,3 1S.Cl

'$0 922 $78. I Y.668.

$0.

520.293 448.

1.309.313.770 -^ - l5.018.

lunr 30, 2007 Junr 30. 2OOh June 30, 2005

Ttir accompanying notes lortn an itiregi

STATEMENT OF NET ASSETS A T D E C E M B E R 3 1 , 2007 (continued)

Fr:ir-l kl I .I T w , pletori Terrpleton 'errpe:on Tenpleton Terrpleton Ternpletsri Ternptc- As:n -, Asinn BRlC Chino Eastern Emerging JOFX Bcnd Growth Fui;d Fund Europe Morkets Fund Fund Fupd Fund Furid

8.787.7hh

12.63 1 ,g 28.699. 3.506.

1,447.027.973 1.713,152,

3T2(78, 38.73 1.

3Y6,7 I 1.267.

10.870,I8 I 9.931.

7.745. 9.720.

1.332. 1.073.796:

I B58. 1,858,

44.~J72.981.47I 675.8i)9.567 10,307,196.27~i 2,874,048,867 9 77.090.028 I .414.279.377 1.696.474. I

UPYi ;Si)! iLSi31 (:!sDi IUSE {EUR) IUSDI

ri of these linzncial ~tateint'nt~

STATEMENT OF NET ASSETS AT DECEMBER 3 1 , 2007 (continued)

.lxnpleton I~rnple'nn Tprnplebn Templeton Tenpletori Tc:*,ple.on Templeton

Fund -0tCI Fund [Euro) Absoiiite Absolute Bulunced

E u r o p w r i

Retw Fund Re1u.n iE:.:oi Returi {LSD] hind

(EUR) [EL?) [LSD! {EdR) [ELRJ ji,SD] (LSD)

Europecr; Globul Global GioSuI (;ionnl Globul

FL-d i m d * %nd * *

' 26Y.735.

7.875.t

81 1. 10,242.

1.260.

Z. W l ,056. 3 .0J1.1 52 5 1.490.0t

16.547. 3.813.

HOH.4h 1.898.45.

204,

871,623,

ll.Y25,000 - 5,400. 1,416,680 732,000 31 075.375 115.604 8,232. 3,132 1,936 95,992 9,680, 293,871 - 13.

932.898 22.168 -

225.lhb 52,

1.652. I .(173.

I Y80.

1 OS

1 I 308

3 5 .Y RtJ

783, 1,352, 1.632.2 15 4.778.778 IZ.ZO2.680 2.390.3 13 3.730.382 801, 10 1 4,272,

2h8.103.302 225,7 15.893 2.063.662.25C 849.235.033 137,795,186 7,332,836 I , 165.753.

345.l40.332 687,965,316 1.26 1.195.083 820,359.689 -^ - 592.514. 370.723.357 501.144.294 I .740.66 I >44 I 804.840, 15Y -^ - 414,867,

'lemplrton Ginbal .Absolute Return (Euro! Fund was lornierly knowr. as Ternpieton Absolute Return (Euro) Fund until August 31. 2007 Templeton Global Absolutr Return (LSDI Fund \vas launched on J u l y 12. 2007

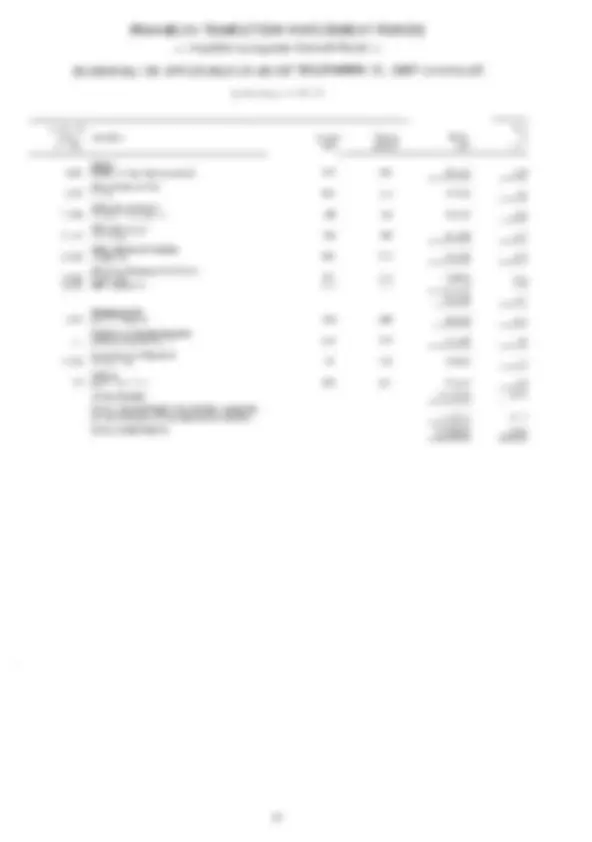

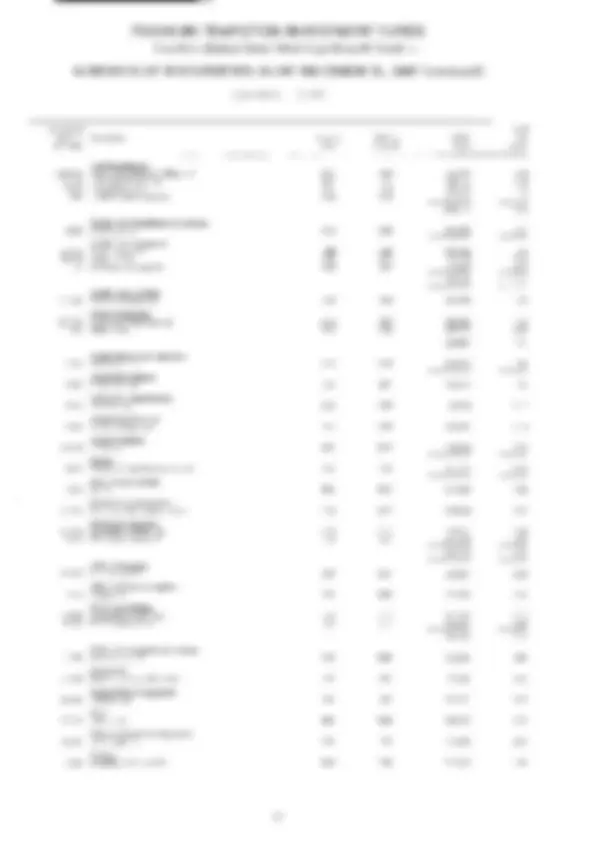

STATEMENT OF NET ASSETS AT DECEMBER 3 1 , 2007 ( c o n t i n u e d )

Terrpkton Terrpleton Templeton Templeton Globcl Global Glohl Globol Bono Bond Ecdty High Furid {Eurr,] Incore Yield Fund Fund Fund IIJSDI !EL?! !LSD! !LSD! ASSETS 1nvest:nent in secur;t;es at market \a:ue (nole 2ih)) Cash .I imr dl-pnsits and repurchase agrremetirs (note 10) AmounLs rrceivahk on sale of investments Amounts rece:\able on suhscripLions Interest and dindends receiiabk, cet Other receivables I:nrt:a:lscd profit on tom-3rd loreign exchange contracts (note 4) Cnreaiised profit on fir.ancial futurc contrat:ts (nmc 7) Uption coiitracE at market valur (note 8 )

,\mounts payab!e on purchases of :tilestmetiE

. 4 ~ 1 ~ i i n t S payable on rrdcmptions Bank overdraft Unrealised loss on forward loreign excharigc CoriLracLs (noLe 41 I!nrealiscd ioss on credit default swaps (note 5 ) I!nrealiscd 105s on intet-est w e swaps (note 6) Unrealised loss on financia. future conlracts (now 7) InvestmenL nlacagement lets p i y h l r (note 31 I axes and expenses payable

509.460,

69,049, 163.046, I

23,710,

8.774.’)17.

7.190.00cI

8 15..30$

I ,366,Y I L I I I .T

134,

6,052.

57.87Y.

5.237. 11.672.

1.141. 790,

4.3 I

96.791.350 2.689.832 2.459.004 11.

June 30. 2007 June 30, 2006 J u n e 30. 2005

‘Templeton Glub;il lligh Yirld Fund w a s 1aur.chcd or. Scptrmher 27, 2007

[LSD) jEIJR) iLS3i [USDI 6.908.36 I ~ I88 3 17.255.9L4 454.567.618 - 7.674.789.337 59.258.439 121.737.457 - 1.922.471,$48 45.200.547 60.587.153 -

The accompanying notes form a n integr

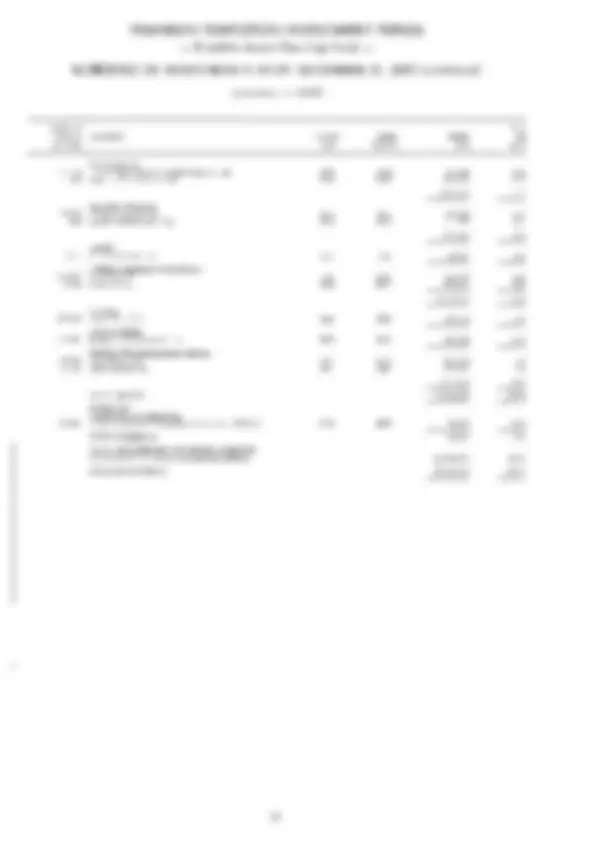

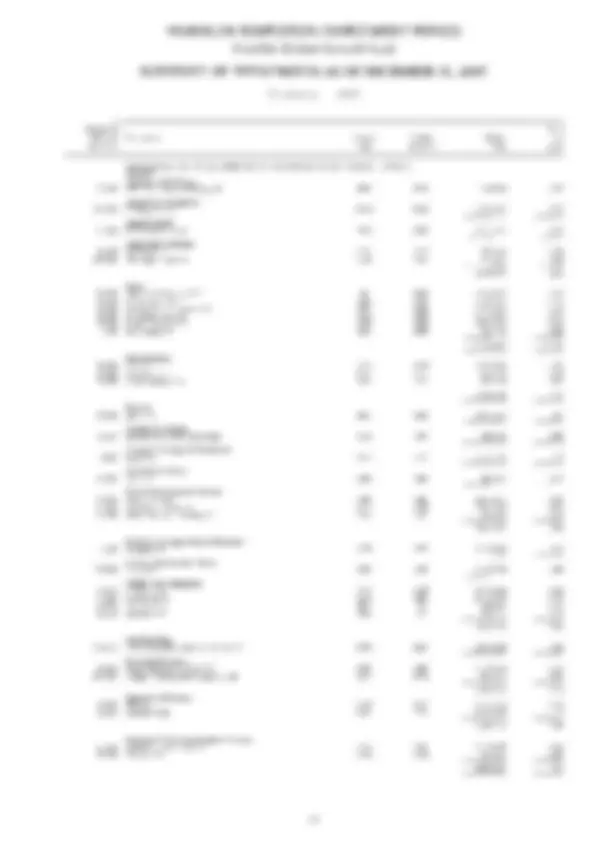

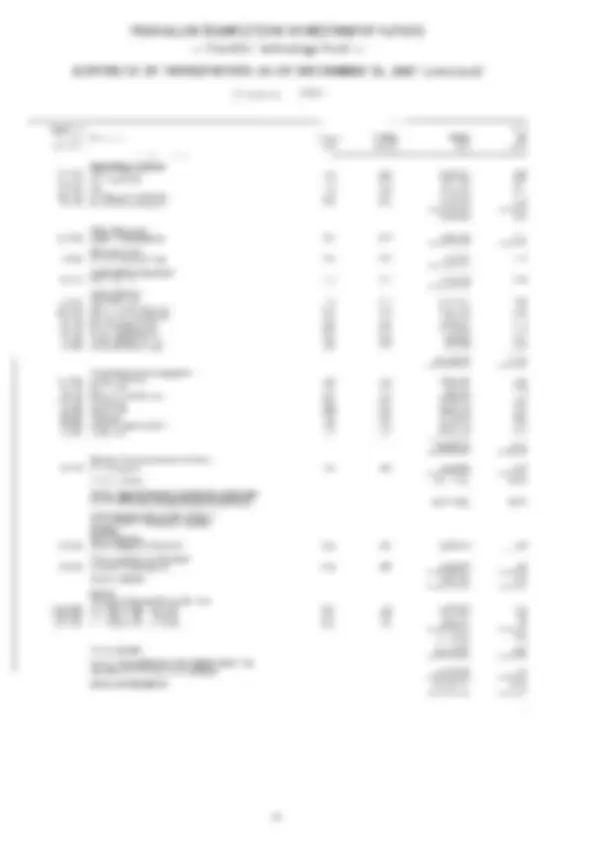

STATEMENT OF NET ASSETS AT D E C E M B E R 3 1 , 2007 (continued)

Terrpleton Teri:plelon -ernp;eton Thuilund I, 5 3ollor u 5 VOiUP Fund 1:qu.c Fund Reserve Fund IUS01 L S D! II,SDI ASSETS 1nvestrncr.i in wciiniies at market value (note 2(b!) Cash Time deposlts a d repurch:ise agrwmenls ( w t c 19) ,\mounts receivable on sale ol ~ r ; v c ~ ~ r n e n ~ .4muunts rccciv:ih;e on subscnptions Interest and divider.ds rewi\ddr. nrt Other receivabies Uni-ealiscd prokt on Ibri.iird loreign t.xchar.gr conLracLs <not(: 4) I.hrealiscd pro fir on finatlcia; tuture contracts (note 7) c)p~i(ir.c o n ~ r a c ~ sat markrt value (note 8 )

I b.llY.6hl 2 981 386 47 884

.-

I 1 3,848, 114.29.3.

1.290. 32,

247.8 I

257,372,895 229.46 5.720 16.350.945'

.4mounrs pa).abiF on purcka5cs o[ iriw5Lmt.nLs Arntiun~spayahlc on rrdcmptions Bar.k (iwrdralt

Uiirealised loss on inwrest riiLr s ~ v a p (note 6 ) I!nrtdiscd loss on financia; tuttire contracts (note 7 ) InvesLmcnL rnanagcincni fees payable (note 3 ) Taxes and expenses pipible

L'i2. 7.805.726 1,947,

6,

TOTAL s E r ASSETS 239.567.169 227.518.456 16.054.

junc 30. 2007 June 3 0 , 2006 June 30. 2005

L S D l :CSD) (LSD) 228.924.862 142,504,919 35.496,92$ 178.853.+06 1413,922,713 10.424, 88.291.983 109.409.607 7.983.

The accompanyng notes Tomi an integral part of these financial statements

- a n k h Biotechnology Discovery Fund - USD anklin Hiotcchnolop I)iscovcry - A (Ace)

STATISTICAL INFORMATION A11 classes in bast. c u r r e n c y u n l e s s otherwise stated

Total Shares Expense Ratio Outstanding Net Asset VdtJe per Share

June 30, 2007 2007 2007 2007 2006

b 296.52h 039 500 000 Sh9 397 131 28,207 695 900 000 h80 254 691

18,hZ1.96Y 446.20!1 422

I O I S I 90% 3 16% 0 9 Y % 0 9 9 8 2 67%

I 9 b

3i) 75 23 17 32 71 21 80

I2 14

0.96% 0 99%

1fi. IO 34 10 43

I OK

0.9S% 2.hLB 2.6691,

2.h14.9.33. 359,479 186 500, 180.653 318 'i70.719 930 I .OIO.h4h. 208,973 501 139.479 493 1,857.

1 x 3 2

8 99

IO 53

2D. 18 55 I9 03

152% 1.51% 1.52%

l j 31 I1 32 12 29

l=J 36

12 32