Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Journal entries and calculations for various companies related to bond transactions, including the amount borrowed, par value at maturity, total repaid, total bond interest expense, discount or premium, unamortized carrying value, and semiannual period-end values. Problems for braeburn, jules, legacy, and shopko.

Typology: Assignments

1 / 11

This page cannot be seen from the preview

Don't miss anything!

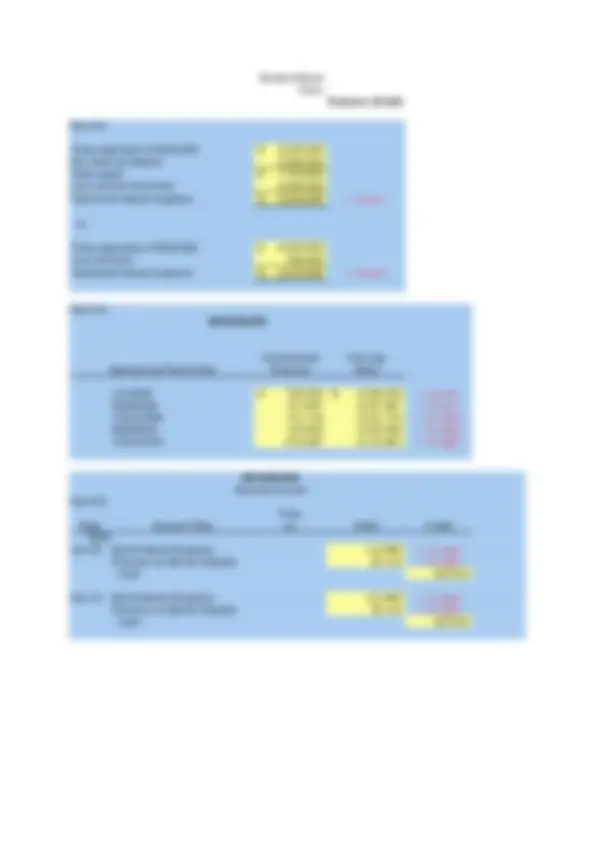

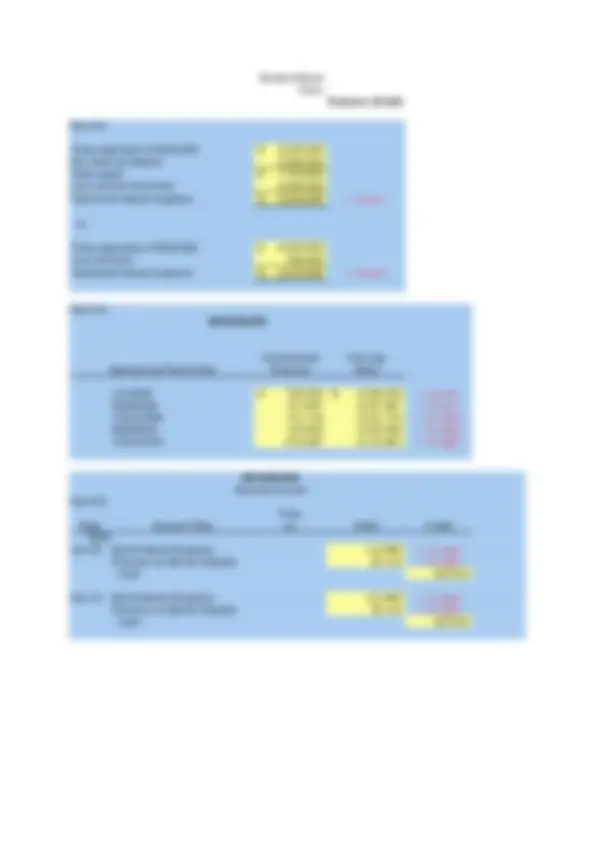

Student Name: Class: Problem 10-02A BRAEBURN General Journal Part 1. Trans. Date Account Titles no. Debit Credit 2009 Jan 1 Cash 3,024, Discount on Bonds Payable 476, Bonds Payable 3,500, Part 2. Cash payment $ 3,024,000 «- Try again! Straight-line discount amortization 311,733 «- Try again! Bond interest expense 140,000 «- Try again! Part 3. Thirty payments of $140,000 $ 4,200, Par value at maturity 3,500, Total repaid $ 7,700, Less amount borrowed 3,024, Total bond interest expense $ 4,676,000 «- Correct! or: Thirty payments of $140,000 $ 4,200, Plus discount 476, Total bond interest expense $ 4,676,000 «- Correct! Part 4. BRAEBURN Unamortized Carrying Semiannual Period End Discount Value 1/1/2009 $ 476,000 $ 3,024,000 «- Correct! 6/30/2009 460,133 $ 3,039,867 «- Correct! 12/31/2009 444,267 $ 3,055,733 «- Try again! 6/30/2010 428,400 $ 3,071,600 «- Try again! 12/31/2010 412,533 $ 3,087,467 «- Try again!

Student Name: Class: Problem 10-02A BRAEBURN General Journal Part 5. Trans. Date Account Titles no. Debit Credit 2009 Jun 30 Bond Interest Expense 311, Discount on Bonds Payable 31,733 «- Try again! Cash 343,467 «- Try again! Dec 31 Bond Interest Expense 311, Discount on Bonds Payable 31,733 «- Try again! Cash 343,467 «- Try again! BRAEBURN General Journal Part 6-1. Trans. Date Account Titles no. Debit Credit 2008 Jan 1 Cash 4,284,000 «- Correct! Premium on Bonds Payable 784,000 «- Correct! Bonds Payable 3,500,000 «- Correct! Part 6-2. Cash payment $ 4,284,000 «- Try again! Straight-line premium amortization Bond interest expense 420,000 «- Try again!

Given Data P10-02A: BRAEBURN Bonds issued, face value $ 3,500, Annual interest 8% Maturity in years 15 Issuance price 3,024, Issue price for Part 6 $ 4,284, Check figures: (3) $ 4,676, (4) 12/31/2010 carrying value 3,087,

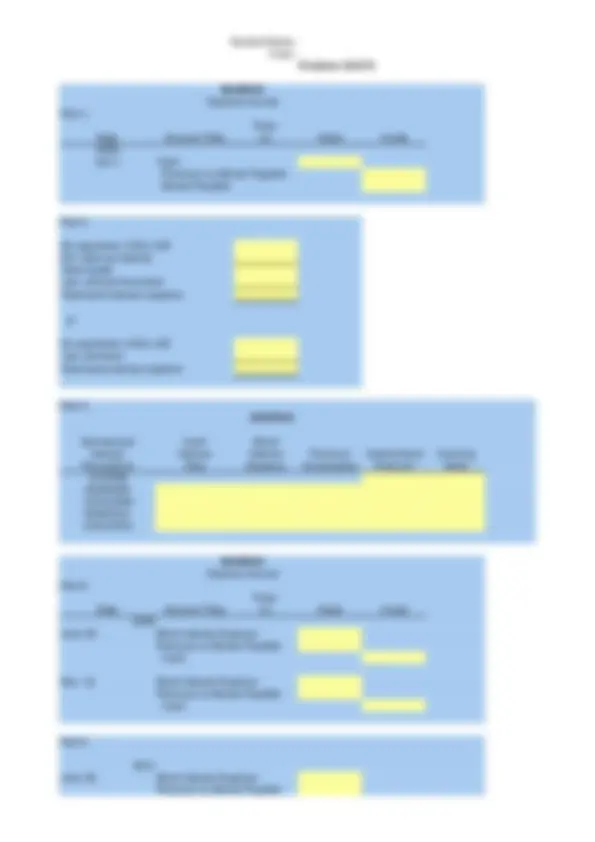

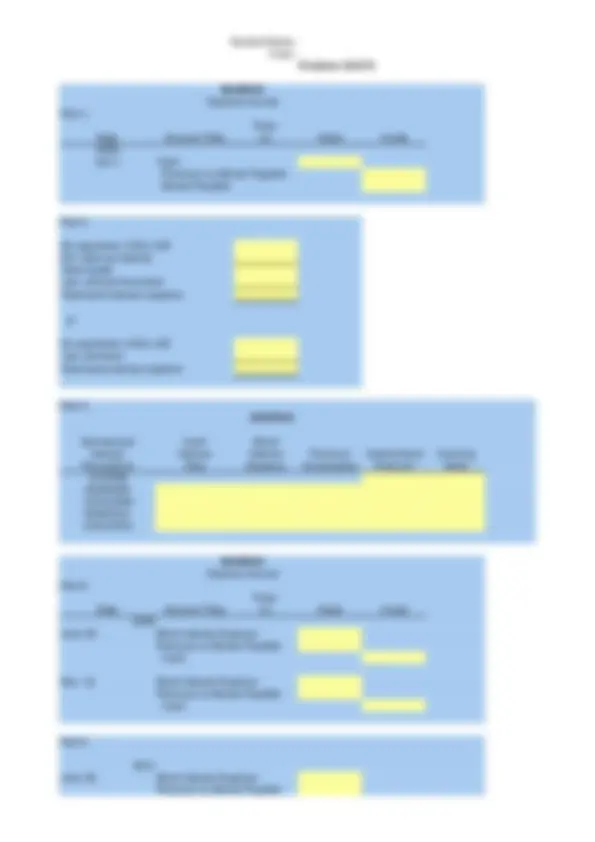

Student Name: Class: Problem 10-03A JULES Part 1. Ten payments of $5,175 $ 51, Par value at maturity 230, Total repaid $ 281, Less amount borrowed 235, Total bond interest expense $ 46,590 «- Correct! or: Ten payments of $5,175 $ 51, Less premium 98, Total bond interest expense $ 46,590 «- Correct! Part 2. JULES Semiannual Interest Unamortized Carrying Period-End Premium Value 1/1/2009 $ 5,160 $ 235,160 «- Correct! 6/30/2009 4,644 234,644 «- Correct! 12/31/2009 4,128 234,128 «- Correct! 6/30/2010 3,612 233,612 «- Correct! 12/31/2010 3,096 233,096 «- Correct! 6/30/2011 2,580 232,580 «- Correct! 12/31/2011 2,064 232,064 «- Correct! 6/30/2012 1,548 231,548 «- Correct! 12/31/2012 1,032 231,032 «- Correct! 6/30/2013 516 230,516 «- Correct! 12/31/2013 - 230,000 «- Correct! JULES General Journal Part 3 Trans. Date Account Titles no. Debit Credit 2009 June 30 Bond Interest Expense 4,084 «- Try again! Premium on Bonds Payable 516 «- Correct! Cash 4, Dec. 31 Bond Interest Expense 4,084 «- Try again! Premium on Bonds Payable 516 «- Correct! Cash 4,

Student Name: Class: Problem 10-06A LEGACY General Journal Part 1. Trans. Date Account Titles no. Debit Credit 2009 Jan 1 Cash Discount on Bonds Payable Bonds Payable Part 2. Eight payments of $8, Par value at maturity Total repaid Less amount borrowed Total bond interest expense or: Eight payments of $8, Plus discount Total bond interest expense Part 3. LEGACY Semiannual Cash Bond Interest Interest Interest Discount Unamortized Carrying Period-End Paid Expense Amortization Discount Value 1/1/ 6/30/ 12/31/ 6/30/ 12/31/ LEGACY General Journal Part 4 Trans. Date Account Titles no. Debit Credit 2009 June 30 Bond Interest Expense Discount on Bonds Payable Cash Dec. 31 Bond Interest Expense Discount on Bonds Payable Cash

Given Data P10-06A: LEGACY Bonds issued, face value $ 345, Annual interest 5% Maturity in years 4 Issuance price $ 332, Market interest rate 6% Check figures: (2) $ 81, (3) Carrying value 338,

Student Name: Class: Problem 10-07A Cash Gain on Retirement of Bonds Part 6: Assume that the market rate on January 1, 2009, is 13% instead of 11%. Without presenting numbers, describe how this change affects amounts reported on Ike's financial statements.

Given Data P10-07A: SHOPKO Bonds issued, face value $ 185, Annual interest 12% Maturity in years 3 Issuance price $ 189, Market interest rate 11% Check figures: (3) Carrying value $ 187, (5) Gain 7,