Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This document serves as notice to American Eagle Airlines, Inc. active and Leave-of-Absence employees of the new health and welfare plan benefits plan.

Typology: Lecture notes

1 / 306

This page cannot be seen from the preview

Don't miss anything!

This document serves as notice to American Eagle Airlines, Inc. active and Leave-of-Absence employees of the new health and welfare plan benefits plan. This new benefit plan becomes effective on January 1, 2009, and this new plan is the Group Health and Welfare Benefits Plan for Employees of American Eagle Airlines, Inc. and Its Affiliates (Plan 501, EIN# 38-2036404, referenced here as the “Eagle Plan”). The information in this notice applies only to the new Eagle Plan (effective January 1, 2009), and not to your existing coverage for 2008.

You will be receiving a Summary Plan Description for the new Eagle Plan in February, 2009. In the meantime, use this document to obtain information about the new Eagle Plan, along with your existing Eagle Summary Plan Description, as many of the provisions will be the same as in the new Eagle Plan.

Please read this notice carefully, and place this notice with your Summary Plan Description(s) (the Summary Plan Descriptions are contained in the Employee Benefit Guide (“EBG”)). When you receive your new Eagle Plan Summary Plan Description is February, 2009, it will contain the information in this document, as well as all provisions, limitations, and exclusions of the new Eagle Plan.

Beginning January 1, 2009, the Eagle Plan’s self-funded medical option – the PPO Copay Option, PPO Deductible Option, Minimum Coverage Option, and Out-of-Area Option – are administered by two network and/or claims administrators: Aetna and Blue Cross and Blue Shield of Texas, replacing UnitedHealthcare. Except where otherwise noted in this document, all references to UnitedHealthcare are replaced by “your network and/or claims administrator.”

In “Contact Information” on page 1, the following text replaces the following sections:

For Information About: Contact: At:

Medical Coverage

Aetna P.O. Box 981106 El Paso, TX 79998-

(800) 572- For other information, visit: Web site: www.aetnanavigator.com Provider directory: www.aetna.com/docfind/custom/ameri caneagle

Out-of-Area Coverage , PPO- Deductible, PPO-Copay and Minimum Coverage Options

Blue Cross and Blue Shield of Texas P.O. Box 660044 Dallas, TX 75266-

(877) 235- For other information, visit: Web site: www.bcbstx.com Provider directory: www.bcbstx.com/americaneagle

Coverage for Incapacitated Child and Special Dependents (PPO-Deductible and PPO- Copay Options)

Aetna P.O. Box 981106 El Paso, TX 79998-

(800) 572- For other information, visit: Web site: www.aetnanavigator.com Provider directory: www.aetna.com/docfind/custom/ameri

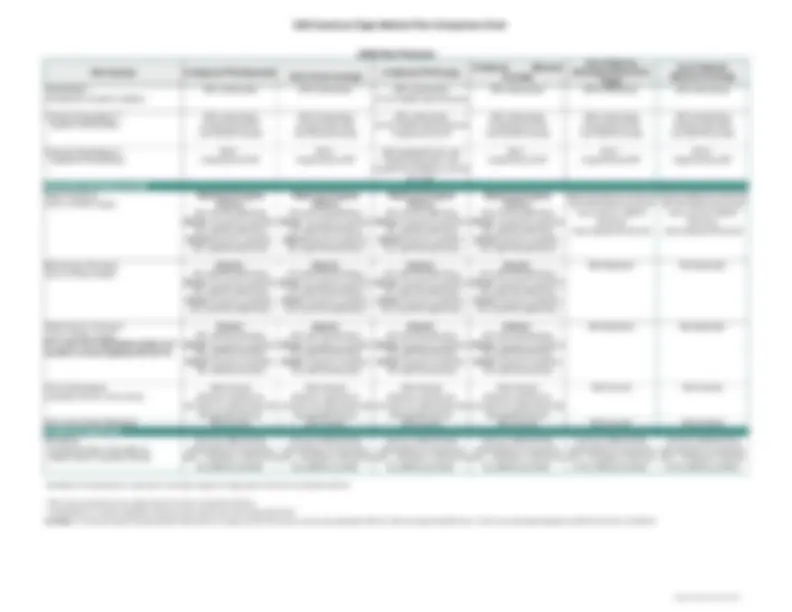

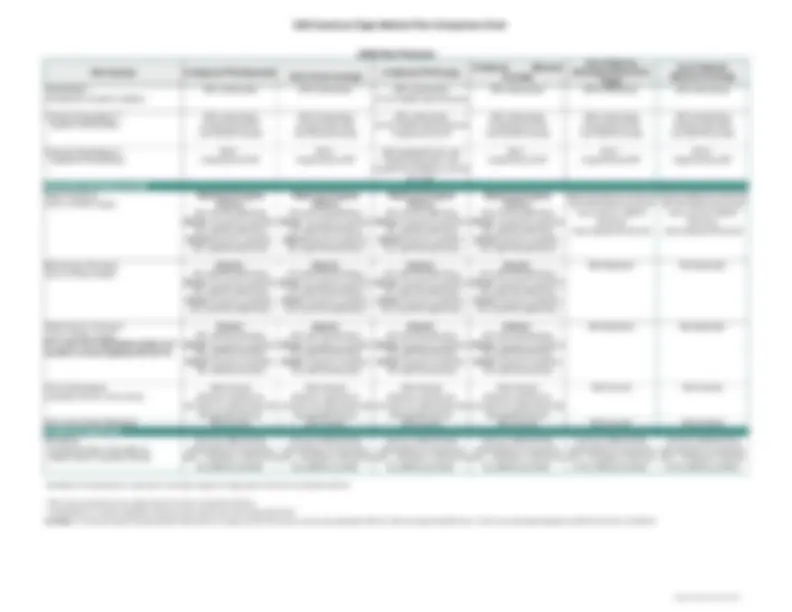

prior (American Airlines, Inc.-sponsored) health and welfare benefit plans:

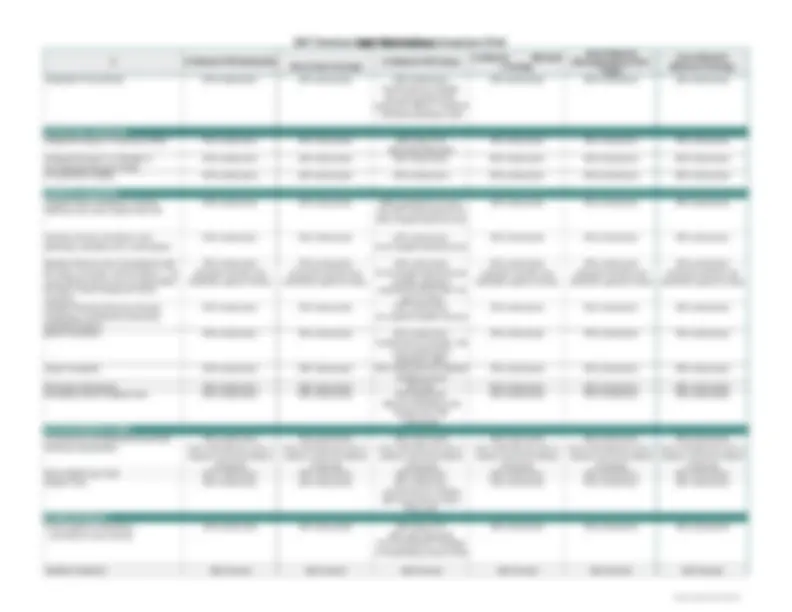

Type of Benefit Self-Funded or Insured

Administrator or Insurer

Funding Mechanism

Medical Benefit PPO Copay Self-funded Aetna or BCBS

PPO Deductible Self-funded Aetna or BCBS

Out-of-Area Self-funded Aetna or BCBS

Company and Employee Contributions, and General Assets of the Company Minimum Coverage Self-funded Aetna or BCBS Company and Employee Premiums HMOs (PR, USVI) Insured Humana or Triple S Company and Employee Premiums TRICARE Supplement

Insured ASI Insurance Co Employee Premiums

Dental Benefit Self-funded MetLife Company and Employee Contributions Vision Benefit OptumHealth Vision Insured OptumHealth Employee Contributions

EyeMed Discount Program EyeMed Employee Contributions Life Insurance Employee Basic Insured MetLife Company Premiums Employee Optional Life

Insured MetLife Employee Premiums

Spouse Life Insured MetLife Employee Premiums Child Life Insured MetLife Employee Premiums AD&D Insurance Basic AD&D Insured LINA (Cigna) Company Premiums VPAI Insured LINA (Cigna) Employee Premiums MPAI Insured LINA (Cigna) Company Premiums Special Purpose Insured LINA (Cigna) Company Premiums Special Risk Insured LINA (Cigna) Company Premiums Terrorism and Hostile Act Accident Insurance

Insured LINA (Cigna) Company Premiums

Optional Short Term Disability

Insured MetLife Employee Premiums

Long Term Disability

Insured MetLife Employee Premiums

Flexible Spending Accounts (FSAs) Health Care FSA Self-funded PayFlex Employee Contributions Dependent Day Care FSA

Self-funded PayFlex Employee Contributions Long Term Care Insurance

Insured MetLife Employee Premiums

In “Benefits at a Glance,” “Medical Benefit Options” on page 5, the following text is inserted before the subheading “Out-of-Area Coverage, Minimum Coverage and PPO- Deductible Options”:

Beginning January 1, 2009, the Eagle Plan’s self-funded medical option – the PPO Copay Option, PPO Deductible Option, Minimum Coverage Option and Out-of-Area Option – are administered by two network and/or claims administrators:

Each state will have one preferred network and/or claims administrator. Your preferred network and/or claims administrator is determined by the ZIP code of your Jetnet alternate address on record. Jetnet allows you to list two addresses — a permanent address (for tax purposes or for your permanent residence) and an alternate address (for a P.O. Box or street address other than your permanent residence). Since many employees maintain more than one residence, you may list both addresses in Jetnet; however, your alternate address determines your network and/or claims administrator. If you do not have an alternate address listed in Jetnet, your network and/or claims administrator is based on your permanent address.

A network and/or claims administrator is the health plan administrator that processes health care claims and manages a network of care providers and health care facilities. The list of the network and/or claims administrators by state resides on Jetnet.

In “Benefits at a Glance” on page 6, delete the section “Supplemental Medical Plan” in its entirety.

In “Enrollment,” “Benefit ID Cards” on page 26, the first paragraph is replaced as follows:

If you elected to participate in Flexible Spending Account(s), PayFlex will mail your an FSA card (your “FSA card”) to you. For information on how the card works, see the Flexible Spending Accounts sections beginning on page 147.

In “Medical Benefits,” “Medical Benefit Options,” “Out-of-Area Coverage, Minimum Coverage and PPO-Deductible Option” on page 48, the following text is inserted after the second paragraph on the page:

In a few rare cases, a U.S. employee may live outside all of the network areas and not have ready access to any of the provider networks. Effective January 1, 2009, if you reside in a ZIP code which is outside of the preferred network providers’ service areas, you will have at least one Out-of-Area Option available. You will not incur any penalty or reduction in benefits if you use a provider outside the preferred administrator’s network, as long as your ZIP code is considered “out-of-area.”

In “Life and Accident Insurance Benefits,” “Employee Term Life Insurance,” “Contributory Term Life Insurance Benefits” on page 117, the following paragraph is added after the first paragraph in the section:

During 2009 annual enrollment, Eagle employees who are currently enrolled in the employee optional life insurance may increase their life insurance by one level for the 2009 plan year, without proof of good health.

Eagle employees who are not currently enrolled in optional life insurance may enroll in optional life insurance without providing proof of good health, equal to one times the employee’s annual salary. This option for increasing coverage without proof of insurability is for the 2009 annual enrollment only (occurring during October, 2008).

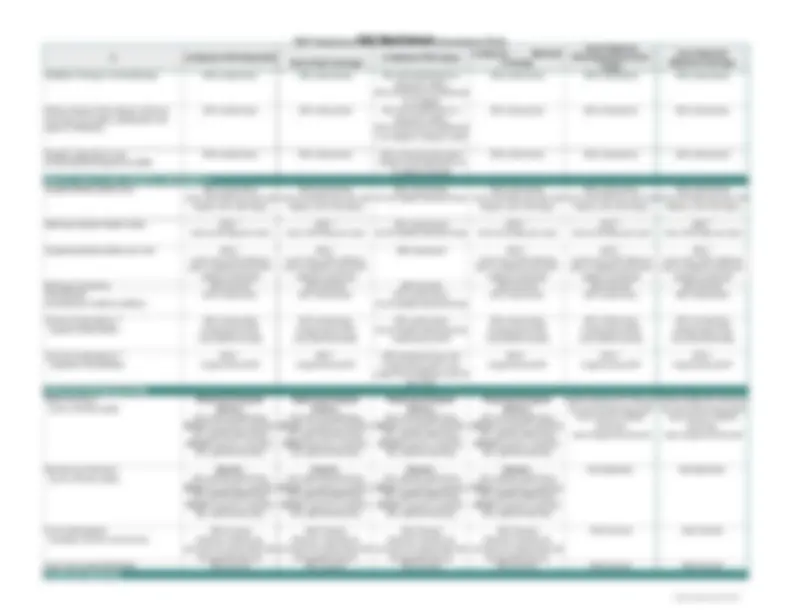

In “Accident Insurance Benefit,” “AD&D and VPAI Benefits” on page 125, directly before the section titled “Travel Accident Services”:

Terrorism and Hostile Act AD&D Insurance for Eagle Pilots and Eagle Flight Attendants

Effective January 1, 2009, the Eagle Plan has increased the Terrorism and Hostile Act AD&D Insurance coverage. The insurance covers both Eagle pilots and Eagle flight attendants while on duty, and covers accidental death, dismemberment, and permanent total disability resulting from terrorism, sabotage, or other hostile actions anywhere in the world.

Effective January 1, 2009, the maximum benefit of this insurance is $200,000 per covered individual, and loss must occur within 365 days after the date of the covered accident.

If Injury Results in: T&HAAI Benefit Is: Loss of Life Full benefit amount Loss of Two or More Hands and/or Feet Full benefit amount Loss of Sight of Both Eyes Full benefit amount Loss of Sight of One Eye Full benefit amount Loss of One Hand or Foot 1/2 benefit amount Loss of Speech 1/2 benefit amount Loss of Hearing in Both Ears 1/2 benefit amount

The aggregate maximum of all benefits paid under this insurance, per accident, is $10,000,000.

In addition, this insurance provides a permanent and total disability (PTD) benefit of $200,000 per covered individual efective January 1, 2009,. If the covered individual becomes permanently and totally disabled from a covered accident; remains permanently and totally disabled for the duration of the waiting period (12 months after the date of the covered accident); and at the end of the waiting period, is certified by a physician to be disabled for the remainder of his/her life; the insurance will pay a lump sum benefit of $200,000, less any other AD&D benefit paid under the Eagle Plan for the covered loss causing the disability.

The section “Long Term Disability Insurance” on pages 139 – 144, is stricken in its entirety. With the separation of Eagle benefits effective January 1, 2009, Eagle will no longer participate in the American Airlines, Inc. Long Term Disability Insurance, but will offer employees participation in fully insured long term disability insurance, underwritten and insured by MetLife. Eagle employees who are currently in claim (either receiving long term disability benefits or are in their elimination period) under the American Airlines, Inc. Long Term Disability Plan shall remain as claimants in the plan until their benefits end (in accordance with the provisions described in the American Eagle Benefits Guide). The new fully insured long term disability insurance (from MetLife) in the new Eagle Health and Welfare Plan (effective January 1, 2009) will cover Eagle participants for disabilities beginning on or after January 1, 2009.

The section “Long Term Disability Insurance” on pages 139 – 144, is replaced with the following text:

All regular employees on U.S. payroll of American Eagles, Inc. and Its Affiliates, which includes Flight Attendants, Non-Management Non-Union, Management and Pilots, are eligible for the Long Term Disability Insurance.

DATE YOU ARE ELIGIBLE FOR INSURANCE

You may only become eligible for the insurance available for your eligible class as shown in the SCHEDULE OF BENEFITS.

You will be eligible for insurance the later of:

ENROLLMENT PROCESS

If you are eligible for the Long Term Disability Insurance, you may enroll by completing the required form. You will receive this form when you enroll for your benefits. If you enroll for Long Term Disability Insurance, you must give permission for your premiums to be deducted from your paychecks.

DATE YOUR INSURANCE TAKES EFFECT

Enrollment When First Eligible You must complete the enrollment process within 60 days of first becoming eligible. Your insurance will take effect on the date you become eligible, if you are an active employee on that date.

If you do not complete the enrollment process within 60 days of first becoming eligible, you will not be able to enroll until the next annual enrollment period

In certain cases insurance may be continued as stated in the section entitled CONTINUATION OF INSURANCE WITH PREMIUM PAYMENT.

Reinstatement of Long Term Disability Insurance If your insurance ends, you may become insured again as follows:

You will not have to complete a new waiting period or provide evidence of your insurability.

If you become insured again as described in either 1 or 2 above, the pre-existing condition limitation for will be applied as if your insurance remained in effect with no interruption.

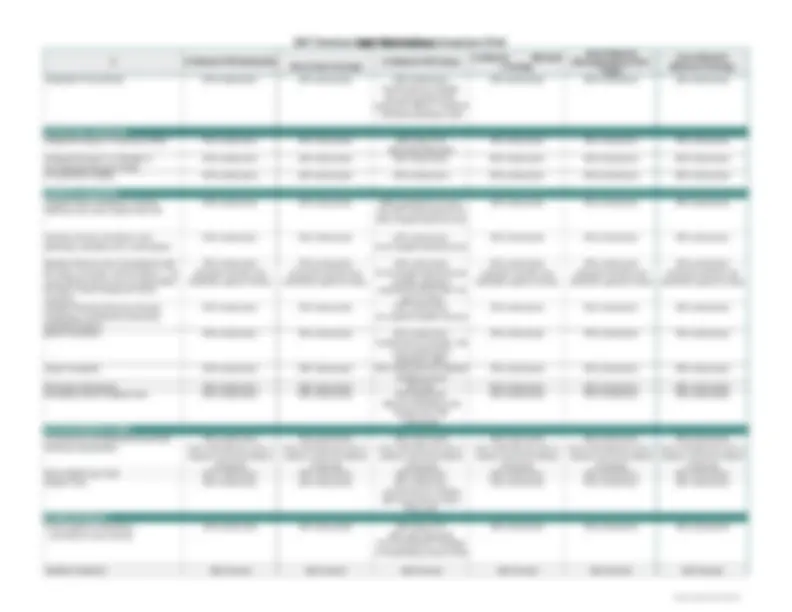

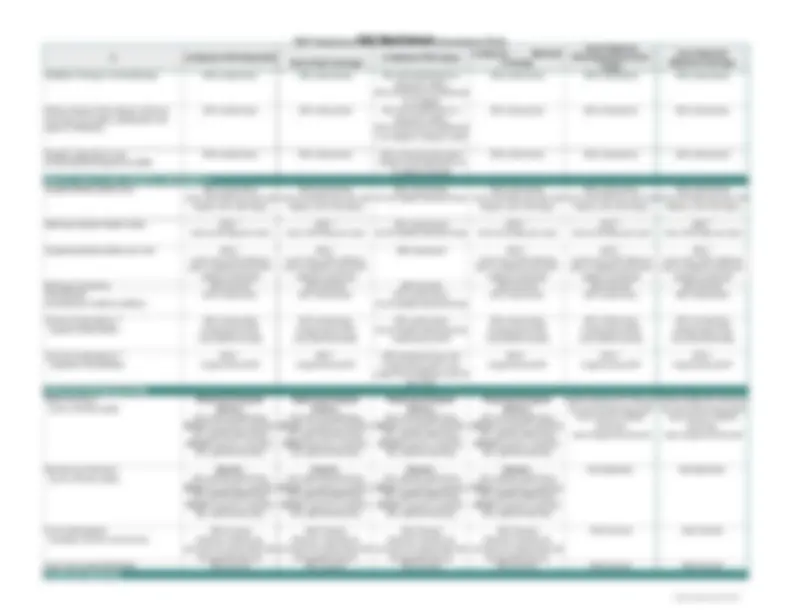

MAXIMUM BENEFIT PERIOD

The maximum benefit period is the later of your Normal Retirement Age or the period shown below:

Your Age on the Date of Your Disability Benefit Period Less than 60 To age 65 60 60 months 61 48 months 62 42 months 63 36 months 64 30 months 65 24 months 66 21 months 67 18 months 68 15 months 69 and over 12 months

*The Maximum Benefit Period is subject to the LIMITED DISABILITY BENEFITS and DATE BENEFIT PAYMENTS END sections.

Note: If you cease or refuse to participate in a Rehabilitation Program that is required by MetLife, your monthly benefit payment will end.

MetLife may require you to provide evidence of insurability. Your evidence of insurability may be deemed unsatisfactory by MetLife if:

You must provide evidence of insurability at your expense, including the expenses for making any necessary copies and paying for postage fees.

If you become disabled while insured, Proof of Disability must be sent to MetLife. When MetLife receives your Proof of Disability, MetLife will review the claim. If MetLife approves the claim, MetLife will pay the monthly benefit, up to the maximum benefit period, as shown in the SCHEDULE OF BENEFITS, subject to THE DATE BENEFIT PAYMENTS END section.

DISABILITY INCOME INSURANCE

To verify that you continue to be disabled without interruption after MetLife’s initial approval, MetLife may periodically request that you send MetLife proof of your disability. Proof may include physical exams, exams by independent medical examiners, in-home interviews or functional capacity exams, as needed.

While you are disabled, your monthly benefit will not be affected if:

Rehabilitation Program Incentive If you participate in a Rehabilitation Program, MetLife will increase your monthly benefit by an amount equal to 10% of the monthly benefit. MetLife will do so before MetLife reduces your monthly benefit by any other income.

Work Incentive While you are disabled, MetLife encourage you to work. If you work while you are disabled and are receiving monthly benefits, your monthly benefit will be adjusted as follows:

Your adjusted monthly benefit will not be reduced by the amount you earn from working, unless your adjusted monthly benefit plus the amount you earn from working and the income you receive from other income exceeds 100% of your predisability earnings, as calculated in the definition of disability.

In addition, the minimum monthly benefit will not apply.

Limit on Work Incentive After the first 24 months following your elimination period MetLife will reduce your monthly benefit by 50% of the amount you earn from working while disabled.

MetLife will reduce your disability benefit by the amount of all other income. Other income includes the following:

REDUCING YOUR DISABILITY BENEFIT BY THE ESTIMATED AMOUNT OF YOUR SOCIAL SECURITY BENEFITS

If there is a reasonable basis for you to apply for benefits under the Federal Social Security Act, MetLife assumes that you have applied for your Social Security benefits. To apply for Social Security benefits means to pursue these benefits until you receive approval from the Social Security Administration, or a notice of denial of benefits from an administrative law judge.

MetLife will reduce the amount of your disability benefit by the amount of Social Security benefits MetLife estimates that you, your Spouse or child(ren) are eligible to receive because of your disability or retirement. MetLife will begin to do this after you have received 24 months of disability benefit payments, unless MetLife has received:

However, within 6 months following the date you became disabled, you must:

If you do not satisfy the above requirements, MetLife will reduce your disability benefits by the estimated Social Security benefits starting with the first disability benefit payment that coincides with the date you were eligible to receive Social Security benefits.

In either case, when you receive approval or final denial of your claim for Social Security benefits as described above, you must notify MetLife immediately. MetLife will adjust the amount of your disability benefit. You must promptly repay MetLife for any overpayment.

SINGLE SUM PAYMENT

If you receive other income in the form of a single sum payment, you must, within 10 days after receipt of such payment, give written proof satisfactory to MetLife of:

While you are disabled, the benefits described in this certificate will not be affected if:

Pre-existing Condition means an illness or accidental injury for which you:

MetLife will not pay benefits for a disability that results from a pre-existing condition, if you have been actively employed for less than 12 consecutive months after the date your disability insurance takes effect.

For Disabilities Due to Alcohol, Drug or Substance Abuse or Addiction, and Mental or Nervous Disorders or Diseases If you are disabled due to:

MetLife will limit your disability benefits to a lifetime maximum equal to the lesser of:

If your disability is due to alcohol, drug or substance addiction, MetLife requires you to participate in an alcohol, drug or substance addiction recovery program recommended by a physician. MetLife will end disability benefit payments at the earliest of the period described above or the date you cease, refuse to participate, or complete a recovery program.

If you are confined in a hospital or mental health facility at the end of the 24 month period for which benefits are to be paid, MetLife will continue your monthly benefits during your confinement. If you continue to be disabled when you are discharged, MetLife will continue your monthly benefits for up to a 90 day recovery period following the end of your hospital or mental health facility confinement. If you become reconfined at any time during this 90 day recovery period and remain confined for at least 14 consecutive days, MetLife will continue your monthly benefits during that confinement period and for one additional recovery period for up to 90 days.

MetLife will determine if a disability is the result of a mental or nervous disorder or disease.

This limitation will not apply to a disability resulting from:

A mental health facility is a facility licensed in the jurisdiction in which it is located to provide care and treatment for a mental or nervous disorder or disease. Such facility must provide care on a 24 hour a day basis under the supervision of a staff of physicians, and must provide a broad range of nursing care on a 24 hour a day basis by or under the direction of a registered professional nurse.

A mental or nervous disorder or disease means a medical condition which meets the diagnostic criteria set forth in the most recent edition of the Diagnostic And Statistical Manual Of Mental Disorders as of the date of your disability. A condition may be classified as a mental or nervous disorder or disease regardless of its cause.

For Disability Due to Neuromuscular, Musculoskeletal or Soft Tissue Disorder Neuromuscular, musculoskeletal or soft tissue disorder including, but not limited to, any disease or disorder of the spine or extremities and their surrounding soft tissue; including sprains and strains of joints and adjacent muscles, unless the disability has objective evidence of:

MetLife will limit your disability benefits to a lifetime maximum equal to the lesser of:

Seropositive Arthritis means an inflammatory disease of the joints supported by clinical findings of arthritis plus positive serological tests for connective tissue disease.

Spinal means components of the bony spine or spinal cord.

Tumor(s) means abnormal growths which may be malignant or benign.

Vascular Malformations means abnormal development of blood vessels.

Radiculopathies means disease of the peripheral nerve roots supported by objective clinical findings of nerve pathology.

Myelopathies means disease of the spinal cord supported by objective clinical findings of spinal cord pathology.

Step 4 You must give MetLife proof of disability not later than 90 days after the date of loss.

If notice of claim or proof of disability is not given within the time limits described in this section, the delay will not cause a claim to be denied or reduced if such notice and proof of disability are given as soon as is reasonably possible.

Items to be Submitted for a Disability Income Insurance Claim When submitting proof of disability on an initial or continuing claim for Disability Income insurance, the following items are required:

Time Limit on Legal Actions. A legal action on a claim may only be brought against MetLife during a certain period. This period begins 60 days after the date proof of disability is filed and ends 3 years after the date such proof of disability is required.

Social Security Assistance Program If your claim for disability benefits under this plan is approved, MetLife provides you with assistance in applying for Social Security disability benefits. Before outlining the details of this assistance, you should understand why applying for Social Security disability benefits is important.

Why You Should Apply For Social Security Disability Benefits Both you and Eagle contribute payroll taxes to Social Security. A portion of those tax dollars are used to finance Social Security’s program of disability protection. Your spouse and children may also be eligible to receive Social Security disability benefits due to your disability.

There are several reasons why it may be to your financial advantage to receive Social Security disability benefits. Some of them are:

1. Avoids Reduced Retirement Benefits Should you become disabled and approved for Social Security disability benefits, Social Security will freeze your earnings record as of the date Social Security determines that your disability has begun. This means that the months/years that you are unable to work because of your disability will not be counted against you in figuring your average earnings for retirement and survivors benefit. 2. Medicare Protection Once you have received 24 months of Social Security disability benefits, you will have Medicare protection for hospital expenses. You will also be eligible to apply for the medical insurance portion of Medicare. 3. Trial Work Period Social Security provides a trial work period for the rehabilitation efforts of disabled workers who return to work while still disabled. Full benefit checks can continue for up to 9 months during the trial work period. 4. Cost-of-Living Increases Awarded by Social Security Will Not Reduce your Disability Benefits MetLife will not decrease your disability benefit by the periodic cost-of-living increases awarded by Social Security. This is also true for any cost-of-living increases awarded by Social Security to your spouse and children.

This is called a Social Security “freeze.” It means that only the Social Security benefit awarded to you and your dependents will be used by MetLife to reduce your disability benefit; with the following exceptions:

a) An error by Social Security in computing the initial amount; b) A change in dependent status; or c) Eagle submitting updated earnings records to Social Security for earnings received prior to your disability.

Over a period of years, the net effect of these cost-of-living increases can be substantial.

How MetLife Assists You in the Social Security Approval Process As soon as you apply for disability benefits, MetLife begins assisting you with the Social Security approval process.

1. Assistance Throughout the Application Process MetLife has a dedicated team of Social Security Specialists. These Specialists, many of whom have worked for the Social Security Administration, work at MetLife. They provide