Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

advanced accountingACCT4210 ocean county collage

Typology: Assignments

1 / 6

This page cannot be seen from the preview

Don't miss anything!

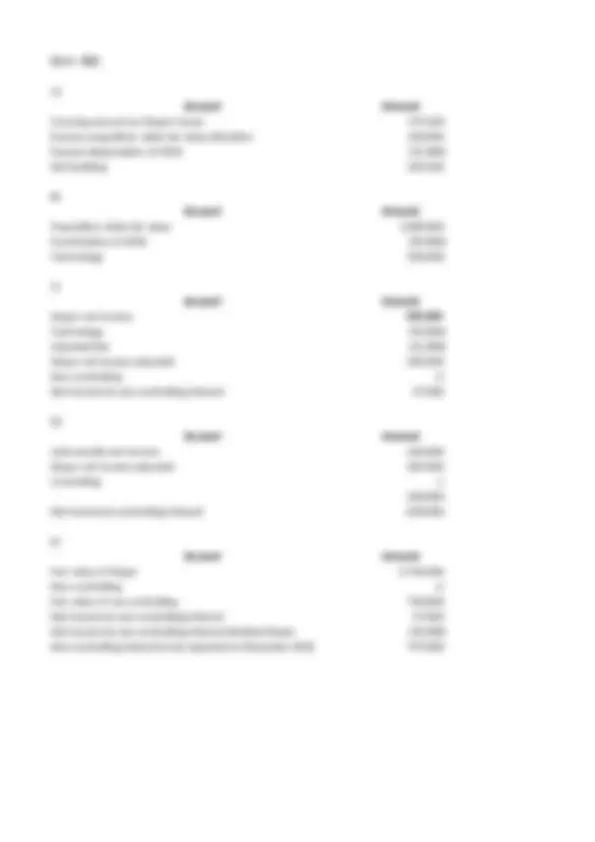

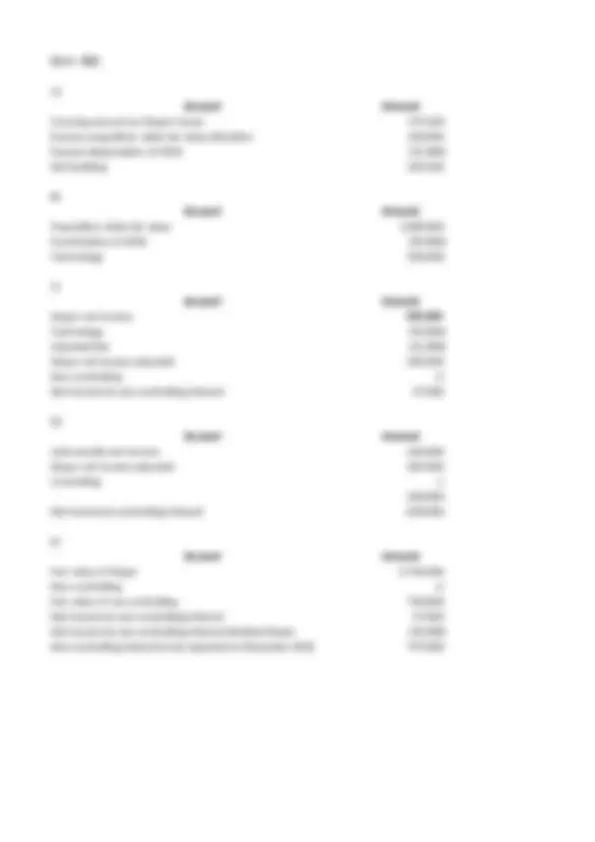

Account Amount Acquisition-date fair value 135, Income accrual for 2017 110, Dividends declared for 2017 (50,000) Amortizations (4,000) Income accrual for 2018 130, Dividends declared for 2018 (40,000) Amortizations (4,000) Investment in Turners Account Balance 277, B) Account Amount Net income of Haynes 240, Net income of Turners 130, Depreciation expense (1,000) Amortization expenses (3,000) Consolidated net income 366, C) Account Amount Equipment Haynes 500, Equipment Turner 300, Allocation basis fair value 5, Depreciation expense (2,000) Consolidated equipment 803, D) Account Debit Credit Investment in Turners 56, Retained earnings 56,

Account F.V of 1/1/2017 F.V of 12/31/2018 B.V of 12/31/ Assets: Cash 75,000 50,000 50, Receivable 193,000 225,000 225, Inventory 281,000 305,000 300, Patents 525,000 600,000 500, Customers relationship 500,000 480,000 450, Equipment 295,000 240,000 235, Goodwill 400,000 100,000 400, Total assets 2,269,000 2,000,000 2,160, Liabilities: Accounts payable (121,000) (175,000) (175,000) Long-term liabilities (450,000) (400,000) (400,000) Total liabilities (571,000) (575,000) (575,000) Net assets 1,698,000 1,425,000 1,585, B) Account Amount Fair value of reporting unit as while 1,425, Book value of reporting units net assets (without goodwill) 1,325, Implied fair value 100, Book value goodwill 400, Goodwill impairment loss 300,

Account Amount Carrying amount on Stayer's book 175, Excuess acquisition–date fair value allocation 150, Excuess depreciation of 2018 (15,000) Net building 310, B) Account Amount Acquisition–date fair value 1,000, Amortization of 2018 (50,000) Technology 950, C) Account Amount Stayer net income 350, Technology (50,000) Adjusted Bul. (15,000) Stayer net income adjusted 285, Non-controlling 0 Net income to non-controlling interest 57, D) Account Amount Johnsonville net income 650, Stayer net income adjusted 285, Controlling 1 228, Net income to controlling interest 878, E) Account Amount Fair value of Stayer 3,750, Non-controlling 0 Fair value of non-controlling 750, Net income to non-controlling interest 57, Net income to non-controlling interest dividend Stayer (10,000) Non-controlling interest to be reported on December 2018 797,

Account Amount Patterson consolidated (31.25 * 80,000) 2,500, Non-controlling fair value (30 * 20,000) 600, Total fair value 3,100, B) C) D) Account Amount Soriano total fair value 3,100, Soriano total book value net assets 1,290, Excess acquisition – date fair value over book value 1,810, Adjusted from book to fair value $ - Buildings and equipment (250,000) Trademarks 200, Patented technology 1,060, Unpatented technology 600, Total 1,610, Goodwill 200, E) Account Amount Revenue 4,400, Expenses (2,350,000) Buildings and equipment 50, Trademarks (20,000) Patented technology (265,000) Unpatented technology (200,000) Consolidated net income 1,615, Account Amount Soriano revenue 1,400, Soriano expense (600,000) Total excess amortization expense (435,000) Before having a contract for adjusting the budget, the two companies have to report the entire amount of assets and liabilities. It's necessary to report the assets and liabilities of the subsidiary at the book values. concerning that these values were adjusted and allocated at a fair value for the acquisition date for the years subsequent to the acquisition. Also, there are no adjusted changing fair values for the assets and liabilities except some particular financial terms