Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

advanced accountingACCT4210 ocean county collage

Typology: Assignments

1 / 16

This page cannot be seen from the preview

Don't miss anything!

Ch 11 – P a. Capital Projects Fund Account Debit Credit Cash $900, Other Financing Sources-Bonds Proceeds $900, a. Government-wide financial statements Account Debit Credit Cash $900, Bonds Payable $900, b. Capital Projects Fund Account Debit Credit Encumbrances $1,100, Fund Balance-Reserved For Encumbrances $1,100, b.Government-wide financial statements No Entry c. General Fund Account Debit Credit Other Financing Uses-Transfers Out $130, Cash $130, Debt Service Fund Account Debit Credit Cash $130, Other Financing Sources-Transfer In $130, c. Government-wide financial statements No Entry d. General Fund Account Debit Credit Fund Balance-Reserved for Encumbrances $11, Encumbrances $11, General Fund Account Debit Credit Expenditures Control-Machinery and Equipment $12, Vouchers Payable $12,

Government-wide financial statements d. Governmental Activities Account Debit Credit Machinery and Equipment $12, Vouchers Payable $12, e. General Fund Account Debit Credit Inventory of Supplies $2, Cash $2, Government-wide financial statements e. Governmental Activities Account Debit Credit Supply Inventory $2, Cash $2, f. Special Revenue Fund Account Debit Credit Cash $90, Deferred Revenues $90, Government-wide financial statements f. Governmental Activities Account Debit Credit Cash $90, Deferred Revenues $90, g. General Fund Account Debit Credit Taxes Receivable $600, Revenues Control $576, Allowance for Uncollectible Current Taxes $24, Government-wide financial statements g. Governmental Activities Account Debit Credit Taxes Receivable $600, Revenues Control $576, Allowance for Uncollectible Current Taxes $24,

Cash $1,000, Other Financing Resources $1,000, f. Fund Financial Statements: Account Debit Credit Expenditure Control -Bonds $900, Expenditure Control -Interest $100, Cash $1,000, Government-wide financial statements Account Debit Credit Bonds Payable $900, Interest Expense $100, Cash $1,000, g. Fund Financial Statement: Account Debit Credit Property tax receivable $800, Revenues-Property tax $768, Uncollectable taxes $32, Government-wide financial statements Account Debit Credit Property tax receivable $800, Revenues-Property tax $768, Uncollectable taxes $32, h. Fund Financial Statement: Account Debit Credit Cash $120, Revenue Control $120, Government-wide financial statements Account Debit Credit Cash $120, Revenue - Reserved for Highway Maintainance $120, i. Fund Financial Statement: Account Debit Credit Investments $300, Contribution Revenue $300,

Government-wide financial statements Account Debit Credit Investments $300, Revenue Donations $300,

Details Governmental Activities Revenues Property taxes $370, Stndent fees $3, Total revenres $373, Expenditure Salaries $100, Rent $70, Equipment $50, Land $30, Maintenance $20, Computer $4, Total expenditure $274, Change in Fund Balance $99,

- Fund balance - ending of the year $99, Details Governmental Activities Assets Cash $53, Property taxes receivable $80, Total Assets $133, Liabilities Vouchers Payable $4, Deferred revenue $30, Total Liabilities $34, Fund balance Unassigned $99, Total Liabilities And Fund balance $133, Fund balance - beginning of the year C Government-Wide Financial Statements Statement of Revenues And Expenditure For the year ended Dec 31, 2017 C Government-Wide Financial Statements Statement of Net Assets For the year ended Dec 31, 2017

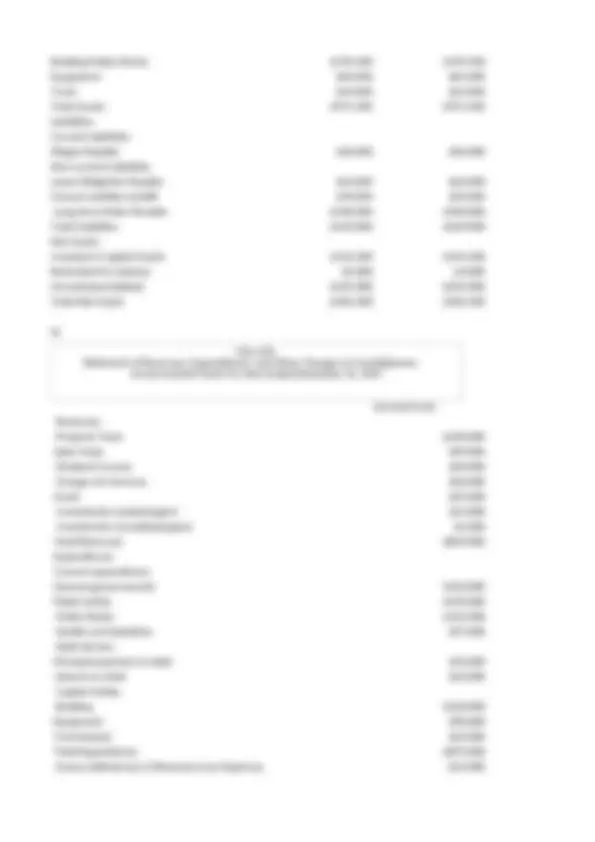

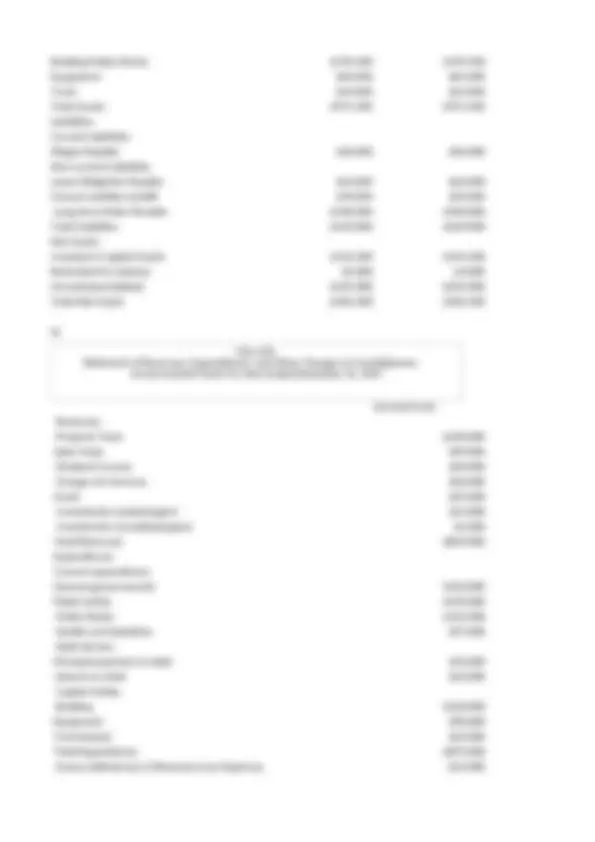

Ch 12 – P a) Governmental Business-type Charges for Operating Functions/Programs Expenses Services Grants and Activities Activities Total Contributions Governmental activities General Government $149,000 $5,000 $14, Public Safety $90,000 $3, Health and Sanitation $70,000 $42, Interest on Debt $16, Total governmental activities $325,000 $50,000 $14, General Revenues: Property taxes $401, Franchise taxes $42, Investments (gain) $13, Total general revenues $456, Change in net assets $195, Net assets-beginning - Net assets-ending $195, Details Total Assets Cash and cash equivalents $62,000 $62, Prepaid expenses $2,000 $2, Governmental Activities Business Type Activities City of Williamson Statement of Activities For the year ended Dec 31, 2017 General Governmental = [ salaries payable 66,000 + 11,000 + 21,000 + 8,000 + 4,000 + compensated absences 13,000 + art work 14,000 + (depreciation on building: 120,000/10 years) 12,000 ] = $149, Public Safety = [(expired insurance) 39,000 + 18,000 +5,000 + 9,000 + (supplies used) 12,000 + (salaries payable) 7,000] = $90, Health and Sanitation = [(salaries payable) 22,000 + 3,000 + 9,000 + 12,000 + 8,000 + (depreciation on equipment: 80,000/5 years) 16,000] = $70, City of Williamson Statement of Net Assets For the year ended Dec 31, 2017

General Fund Assets Cash and cash equivalents $62,000 $62, Prepaid expenses $2,000 $2, Investments $103,000 $103, Receivables (net) $81,000 $81, Inventories $3,000 $3, Total assets $251,000 $251, Liabilities Salaries payable $19,000 $19, Total Liabilities $19,000 $19, Fund Balance Nonspendable $5,000 $5, Committed For Equipment $12,000 $12, Unassigned $215,000 $215, Total Fund Balance $232,000 $232, Total Liabilities and Fund Balabce $251,000 $251, Total Government Funds City of Williamson Balance Sheet For the year ended Dec 31, 2017

Capital Grants and Contributions -$130, -$87, -$28, -$16, -$261, ompensated absences 000 000 + (salaries payable) preciation on equipment:

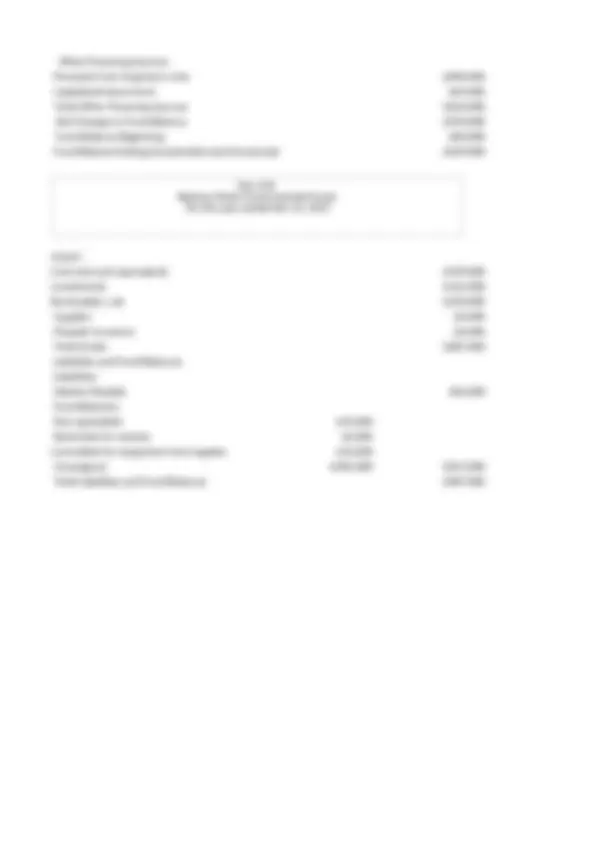

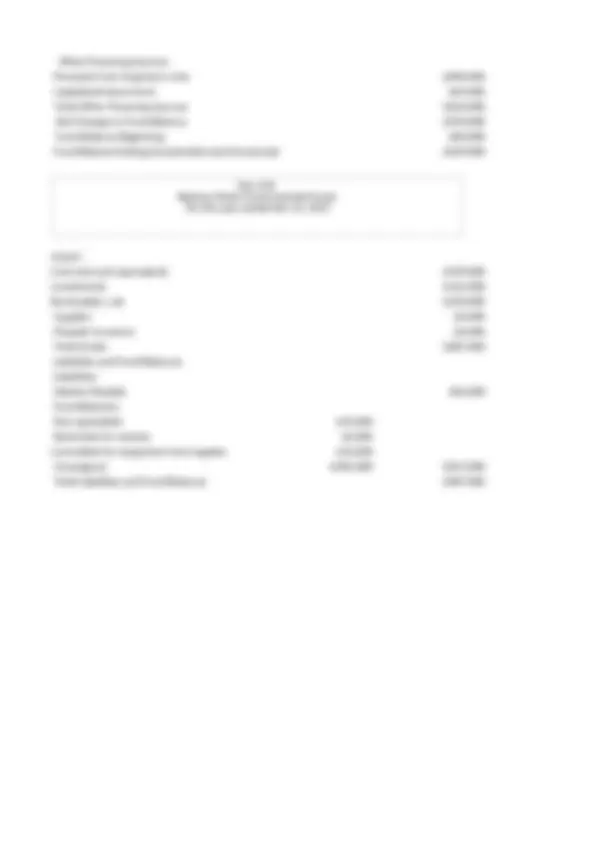

Ch 12 – P a) Expenses Program Government Activities: General Government $180,000 $15, Public Safety $158,000 $8, Public Works $159,500 $12, Health and Sanitation $37,000 $31, Interest on Debt $42,000 $- Total Activities $576,500 $66, General Revenues: Property Taxes $630,000 $630, Sales Taxes $99,000 $99, Dividend Income $20,000 $20, Gain on Investment Sale $14,000 $14, Gain on Investment Value $5,000 $5, Total General revenues $768,000 $768, Change in Net Assets Change during 2017. $282,500 $282, Net assets-beginning $120,000 $120, Net assets-ending $402,500 $402, Assets: Total Cash and Cash Equivalents $139,000 $139, Prepaid Expenses $6,000 $6, Investments $116,000 $116, Receivables (net) $120,000 $120, Supplies $6,000 $6, Total Curent Assets $387,000 $387, Capital Assets: Building-General Government $240,000 $240, Program Revenues Charges for Services Governmental Activities City of B. Statement of Activities For the year ended Dec 31, 2017 City of B. Statement of Net Assets For the year ended Dec 31, 2017

Building Public Works $199,500 $199, Equipment $81,000 $81, Truck $64,000 $64, Total Assets $971,500 $971, Liabilities: Current Liabilities Wages Payable $36,000 $36, Non-current Liabilities Lease Obligation Payable $64,000 $64, Closure Liability-Landfill $39,000 $39, Long-term Notes Pavable. $430,000 $430, Total Liabilities $569,000 $569, Net Assets: Invested in Capital Assets $154,500 $154, Restricted For Salaries $3,000 $3, Unrestricted (deficit) $245,000 $245, Total Net Assets $402,500 $402, b) General Fund Revenues: Property Taxes $630, Sales Taxes $99, Dividend Income $20, Charges for Services $66, Grant $25, Investments (realized gain) $14, Investments (unrealized gains) $5, Total Revenues $859, Expenditures: Current expenditures: General governmental $150, Public Safety $149, Public Works $122, Health and Sanitation $37, Debt Service: Principal payment on debt $10, Interest on debt $42, Capital Outlay: Building $210, Equipment $90, Truck-leased $64, Total Expenditures $874, Excess (deficiency) of Revenues over Expenses -$15, City of B. Statement of Revenues, Expenditures, and Other Changes in Fund Balances Governmental Funds For Year Ended December 31, 2017

Grants and Contributions -$165, -$150, -$147, $25,000 $19, $- -$42, $25,000 -$485, Net (Expense) Revenue and Change in Net Assets Governmental Activities City of B. ement of Activities year ended Dec 31, 2017