Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This is the market analysis project for week 3

Typology: Assignments

1 / 3

This page cannot be seen from the preview

Don't miss anything!

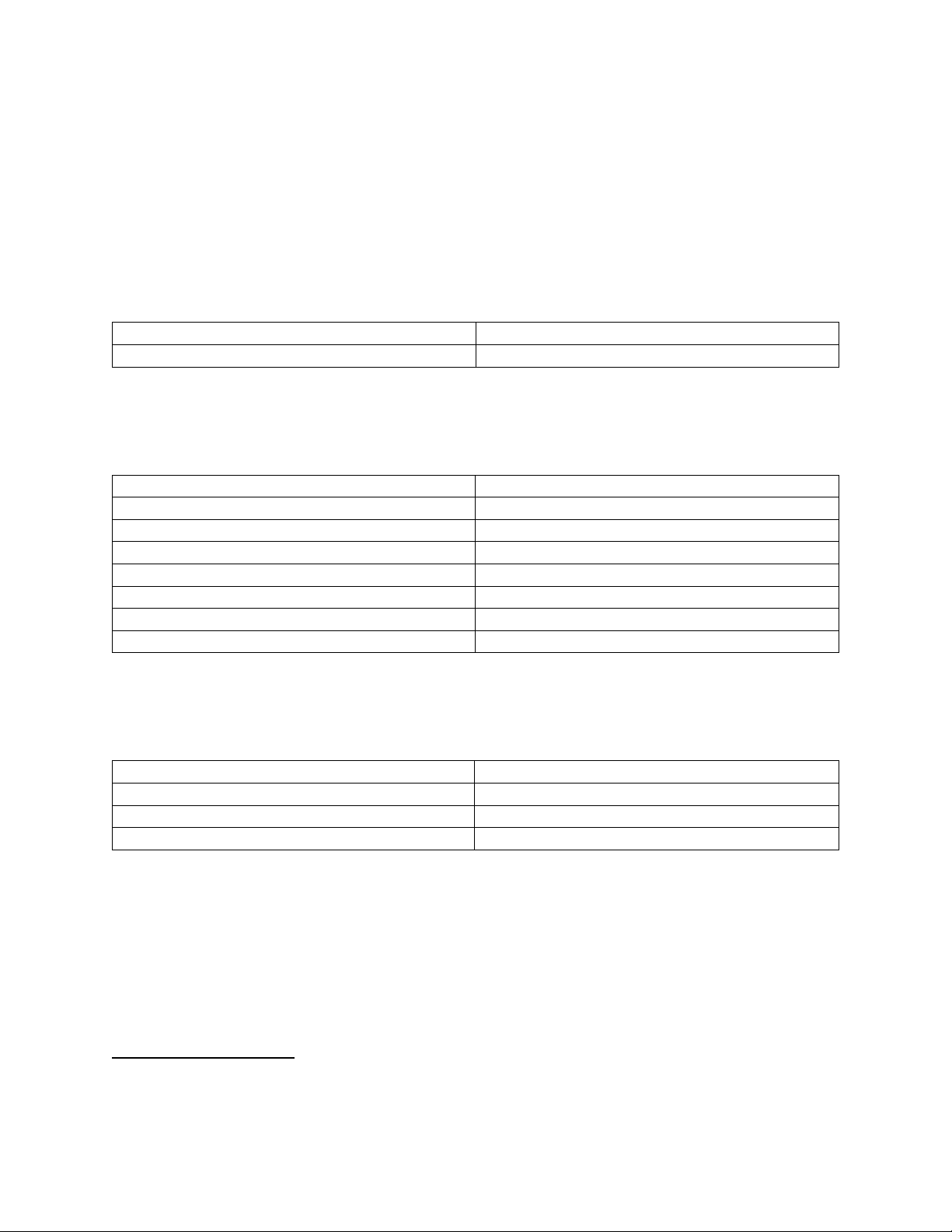

From the text, the Weighted Average Cost of Capital is: WACC = (E/V) x RE + (D/V) x RD x (1- TC) (Eq. 14-6) In this Research Project, the WACC for a selected company will be determined. Fill in the table to identify your selected company: Name of Company/Stock Hershey Company Ticker Symbol HSY Part 1: Cost of Debt^1 Complete the following table to arrive at the Cost of Debt and Tax Rate. Interest Income (Expense) – last 2 years avg (127+149)/2= $138,000, Earnings Before Tax – last 3 years total 1.797+1.495+1.381= $4,673,000, Taxation – last 3 years total 314+22+234= $570, Corporate Tax Rate, TC^2 570,000/4,673,000,000= 0.000121 or 0.012% Current Debt 942,000, LT Debt & Leases 4,087,000, Total Debt 942+4087= $5,029,000, Cost of Debt^3 138,000,000/5,029,000,000=0.0274 or 2.74% Part 2: Cost of Equity and CAPM Components Complete the table and determine the cost of equity. Show your calculations. Beta, β E 0. Historical Market Return, i M Assume 9% Risk Free Rate, i f Assume 2% Cost of Equity, i E 0.02+(0.45(0.09-0.02))=0.515 or 5.15%

(^1) The inputs from Mergent provide a close approximation to the Cost of Debt (^2) Divide the Taxation last 3 years line item by Earnings Before Tax for the last 3 years, as a percent (^3) Interest Income (Expense) last 2-year average divided by the Total Debt

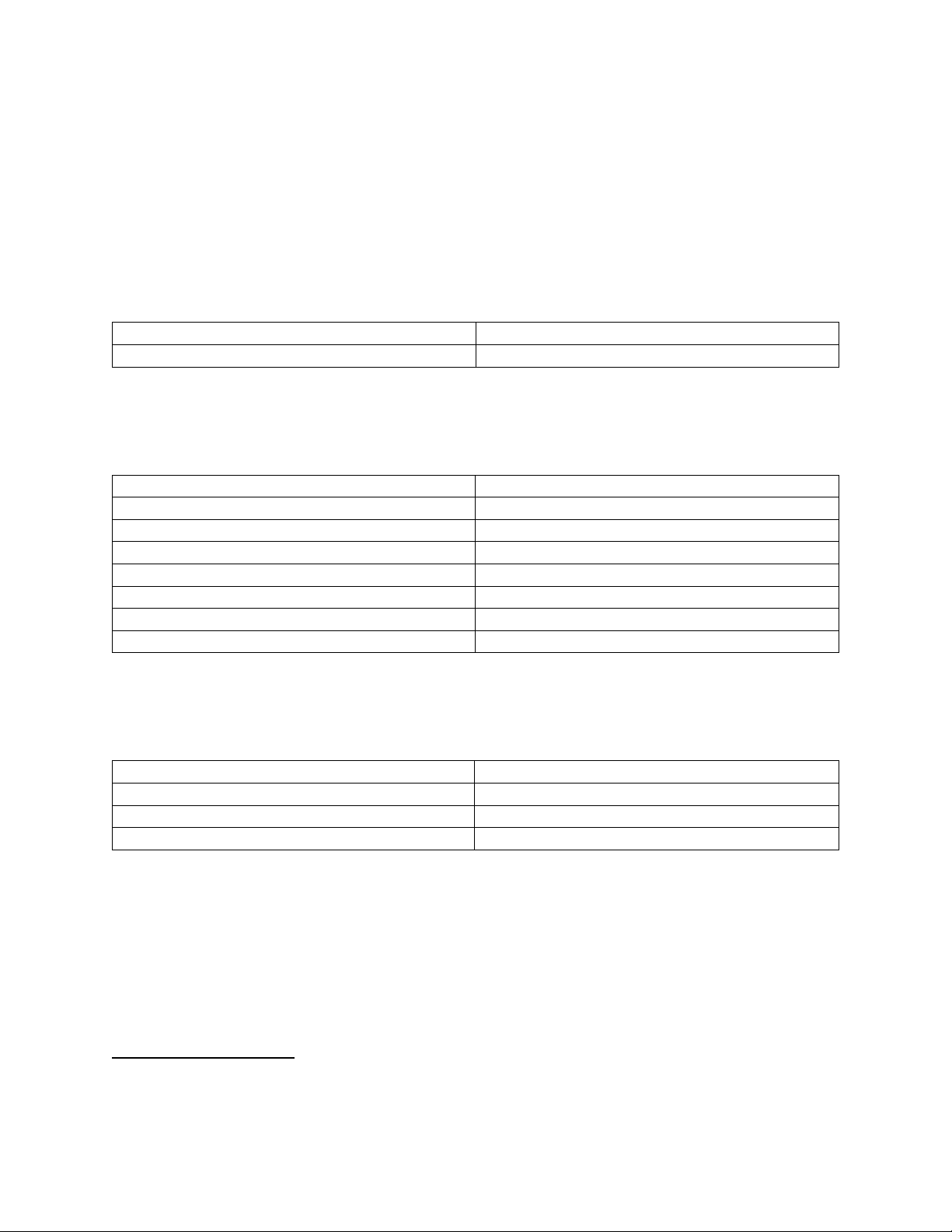

Part 3: Weighted Average Cost of Capital Draw on your work in Parts 1 and 2 to determine D/V and E/V. Total Debt Value $5,029,000, Total Equity Value 30,311,000, Total Firm Value 35,340,000, Total Debt to Total Firm Value (D/V) (5,029/35,340) = 0.142 or^ 14.2% Total Equity to Total Firm Value (E/V) (30,311/35,340) = 0.858 or 85.8% Show your calculation of your selected company’s WACC. WACC = (E/V) x RE + (D/V) x RD x (1- TC) WACC = 0.8580.515 + 0.142 0.274 * (1- 0.00012) = 0.8580.515 + 0.142 0. = 0.442 + 0. WACC= 0.481 or 48.1% Suppose the company you selected embarked on a recapitalization that relied upon a 50% D/V and a 50% E/V. Assuming that the component costs stayed the same, calculate the company’s WACC under this scenario. Show your calculation. Would it make sense for the company to make this change? WACC= 0.50* 0.515 + 0.50* 0.142* (1-0.00012) = 0.50* 0.515+ 0.50* 0. = 0.258 + 0. WACC= 0.395 or 39.5% Part 4: Sustainable Growth Recall from Module 1, that a firm can achieve its Sustainable Growth Rate by using internal equity financing and a constant debt ratio. Sustainable growth rate = (ROE ∙ b ) / [1-(ROE ∙ b )] (Eq. 4-3) As defined in the text, b is the retention or plowback ratio. For your selected company, use Mergent’s data to calculate the Sustainable Growth Rate for the most recent period. Show your calculations. How would you interpret the result for the company you selected? Does this seem reasonable to you? b= 1- (3.507/7.34)